Two Harbors Investment Corp. Webinar Series June 2012 Investing in Sub-Prime

1 Two Harbors’ Webinar: Investing in Sub-Prime William Roth Co-Chief Investment Officer Christine Battist Managing Director, Investor Relations

2 Safe Harbor Statement Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our RMBS, the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover certain losses that are expected to be temporary, changes in interest rates or the availability of financing, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, the inability to acquire mortgage loans or securitize the mortgage loans we acquire, the inability to acquire residential real properties at attractive prices or lease such properties on a profitable basis, the impact of new or modified government mortgage refinance or principal reduction programs, and unanticipated changes in overall market and economic conditions. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

3 Two Harbors’ Company Overview Our mission is to be recognized as the industry-leading hybrid mortgage REIT. We’ll accomplish this goal by achieving excellence in four areas: ▪ Superior portfolio construction and fluid capital allocation through rigorous security selection and credit analysis ▪ Unparalleled risk management with a strong focus on hedging and book value stability ▪ Targeted diversification of the business model through asset securitization and single family residential properties ▪ Leading governance and disclosure practices We strive to deliver value to our stockholders. Since our formation, we have: ▪ Declared total dividends of $4.141 per common share ▪ Delivered a total shareholder return of 58%2 (1) Historic dividends declared by the company may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. Total dividends calculated through the second quarter 2012 dividend declaration. (2) Two Harbors’ total stockholder return is calculated for the period October 29, 2009 through June 13, 2012. Total stockholder return is defined as capital gains on stock price including dividends. Source: Bloomberg.

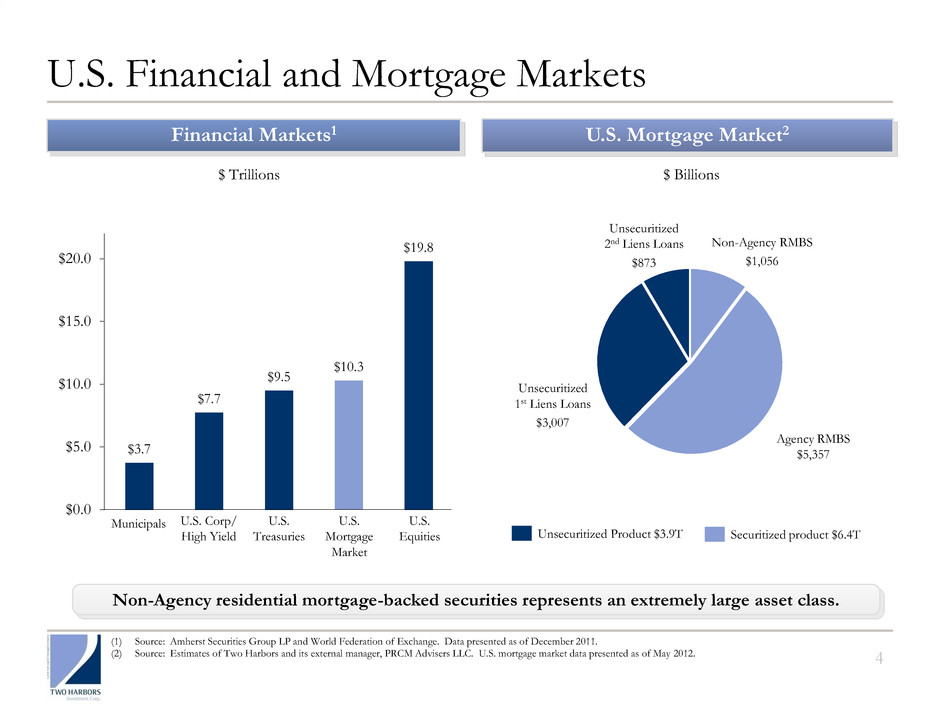

4 U.S. Financial and Mortgage Markets $ Billions Non-Agency RMBS $1,056 Agency RMBS $5,357 Unsecuritized 1st Liens Loans $3,007 Unsecuritized 2nd Liens Loans $873 Non-Agency residential mortgage-backed securities represents an extremely large asset class. Unsecuritized Product $3.9T Securitized product $6.4T Financial Markets1 U.S. Mortgage Market2 $ Trillions (1) Source: Amherst Securities Group LP and World Federation of Exchange. Data presented as of December 2011. (2) Source: Estimates of Two Harbors and its external manager, PRCM Advisers LLC. U.S. mortgage market data presented as of May 2012. $3.7 $7.7 $9.5 $10.3 $19.8 $0.0 $5.0 $10.0 $15.0 $20.0 U.S. Treasuries U.S. Mortgage Market U.S. Equities Municipals U.S. Corp/ High Yield

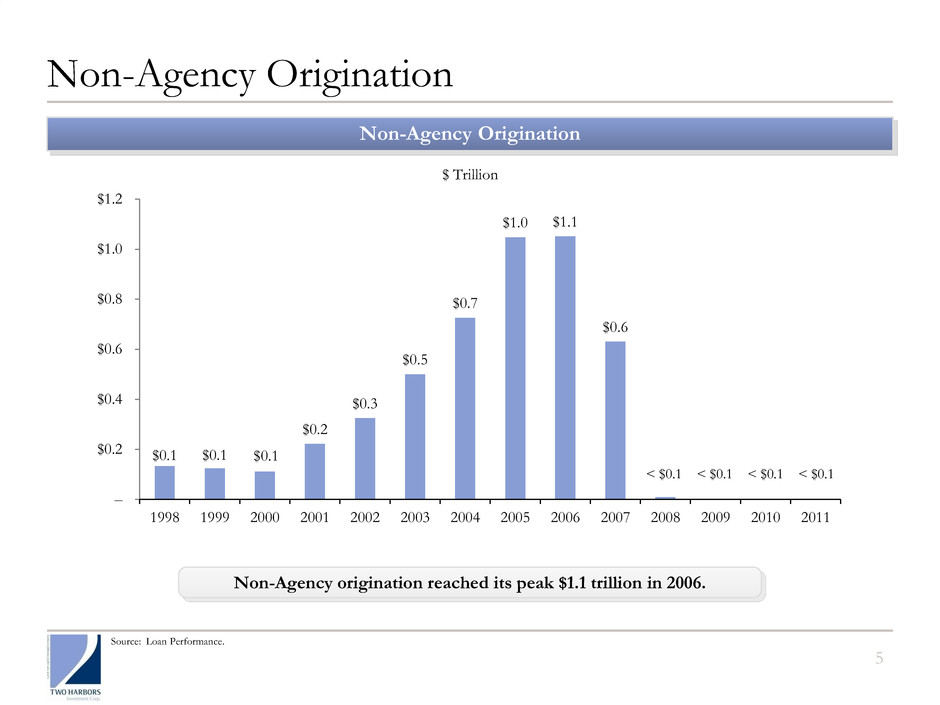

Non-Agency Origination 5 Non-Agency origination reached its peak $1.1 trillion in 2006. $0.1 $0.1 $0.1 $0.2 $0.3 $0.5 $0.7 $1.0 $1.1 $0.6 – $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Non-Agency Origination $ Trillion Source: Loan Performance. < $0.1 < $0.1 < $0.1 < $0.1

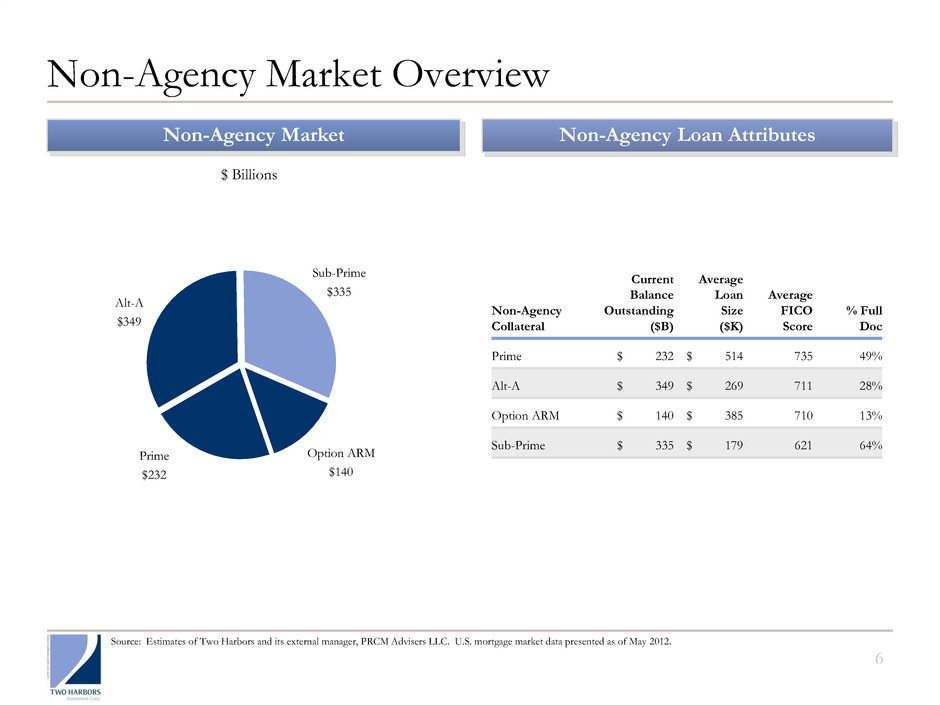

6 Non-Agency Market Overview Prime $232 Alt-A $349 Sub-Prime $335 Option ARM $140 Non-Agency Market Non-Agency Loan Attributes $ Billions Non-Agency Collateral Current Balance Outstanding ($B) Average Loan Size ($K) Average FICO Score % Full Doc Prime $ 232 $ 514 735 49% Alt-A $ 349 $ 269 711 28% Option ARM $ 140 $ 385 710 13% Sub-Prime $ 335 $ 179 621 64% Source: Estimates of Two Harbors and its external manager, PRCM Advisers LLC. U.S. mortgage market data presented as of May 2012.

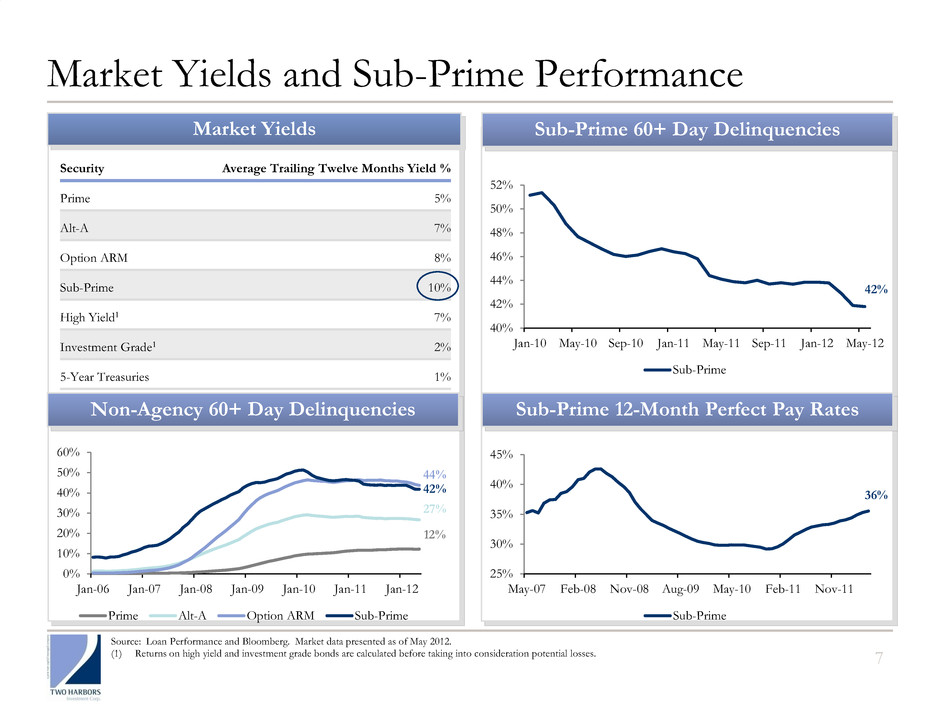

7 Market Yields and Sub-Prime Performance Sub-Prime 60+ Day Delinquencies Sub-Prime 12-Month Perfect Pay Rates Security Average Trailing Twelve Months Yield % Prime 5% Alt-A 7% Option ARM 8% Sub-Prime 10% High Yield1 7% Investment Grade1 2% 5-Year Treasuries 1% Non-Agency 60+ Day Delinquencies 42% 25% 30% 35% 40% 45% May-07 Feb-08 Nov-08 Aug-09 May-10 Feb-11 Nov-11 Sub-Prime 36% 0% 10% 20% 30% 40% 50% 60% Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Prime Alt-A Option ARM Sub-Prime 40% 42% 44% 46% 48% 50% 52% Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sub-Prime 44% 42% 27% 12% Market Yields Source: Loan Performance and Bloomberg. Market data presented as of May 2012. (1) Returns on high yield and investment grade bonds are calculated before taking into consideration potential losses.

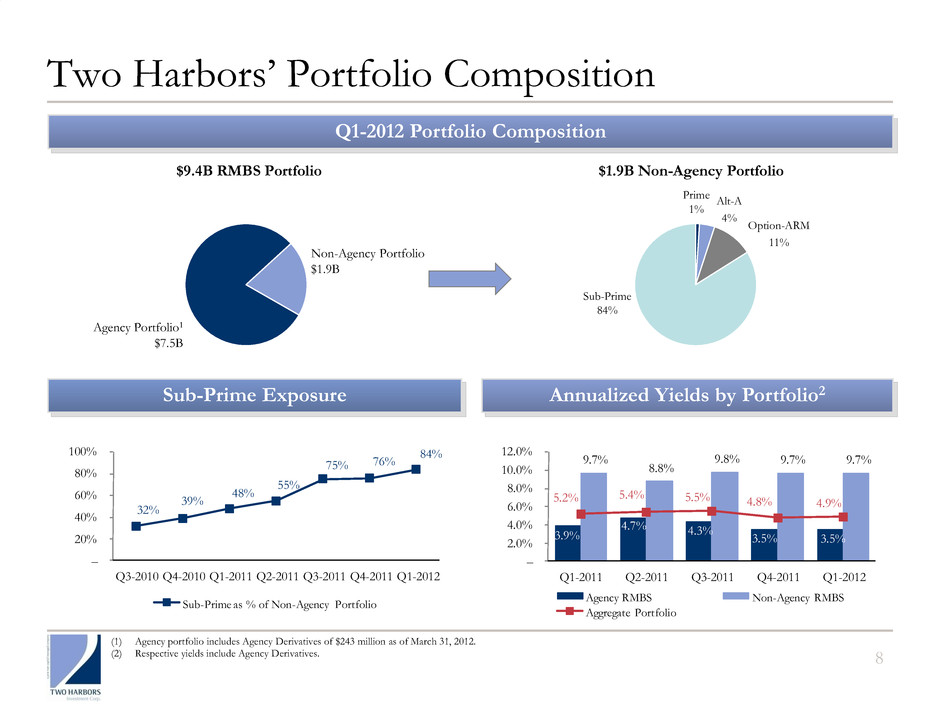

Two Harbors’ Portfolio Composition 8 Agency Portfolio1 $7.5B Non-Agency Portfolio $1.9B Sub-Prime 84% Option-ARM 11% Prime 1% Alt-A 4% Annualized Yields by Portfolio2 3.9% 4.7% 4.3% 3.5% 3.5% 9.7% 8.8% 9.8% 9.7% 9.7% 5.2% 5.4% 5.5% 4.8% 4.9% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q1-2011 Q2-2011 Q3-2011 Q4-2011 Q1-2012 Agency RMBS Non-Agency RMBS Aggregate Portfolio Sub-Prime Exposure 32% 39% 48% 55% 75% 76% 84% – 20% 40% 60% 80% 100% Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-201 Q1-2012 Sub-Prime as % of Non-Agency Portfolio $1.9B Non-Agency Portfolio $9.4B RMBS Portfolio Q1-2012 Portfolio Composition (1) Agency portfolio includes Agency Derivatives of $243 million as of March 31, 2012. (2) Respective yields include Agency Derivatives.

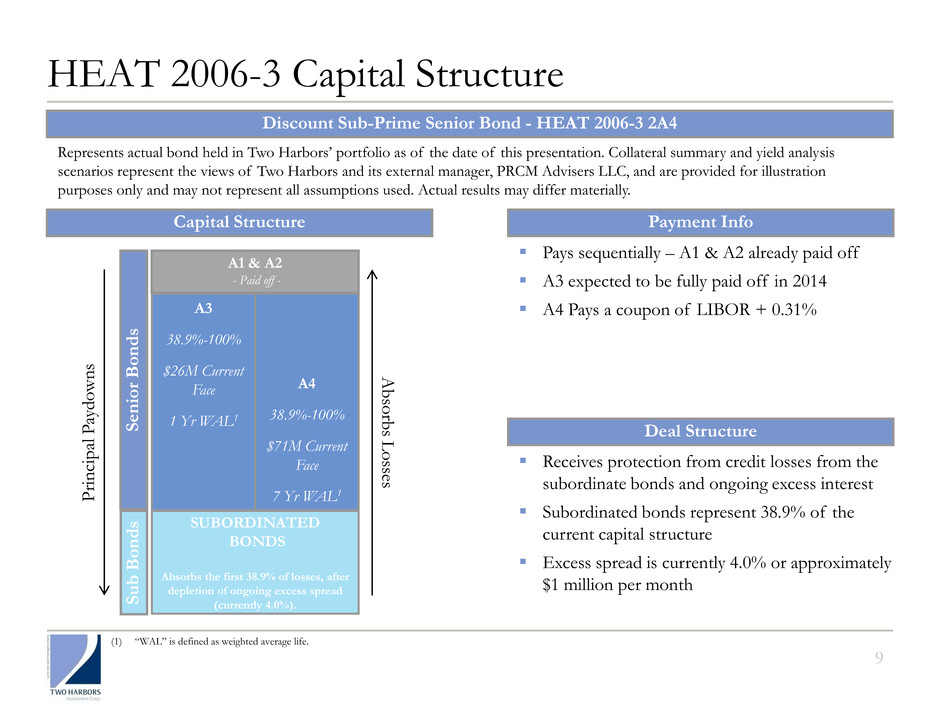

Discount Sub-Prime Senior Bond - HEAT 2006-3 2A4 HEAT 2006-3 Capital Structure 9 Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Pays sequentially – A1 & A2 already paid off A3 expected to be fully paid off in 2014 A4 Pays a coupon of LIBOR + 0.31% Payment Info Capital Structure S e n ior Bo n d s SUBORDINATED BONDS Absorbs the first 38.9% of losses, after depletion of ongoing excess spread (currently 4.0%). A3 38.9%-100% $26M Current Face 1 Yr WAL1 A4 38.9%-100% $71M Current Face 7 Yr WAL1 A1 & A2 - Paid off - S u b Bon d s Receives protection from credit losses from the subordinate bonds and ongoing excess interest Subordinated bonds represent 38.9% of the current capital structure Excess spread is currently 4.0% or approximately $1 million per month Deal Structure Pr in ci p al P ay d o wn s Ab so rb s Lo sses (1) “WAL” is defined as weighted average life.

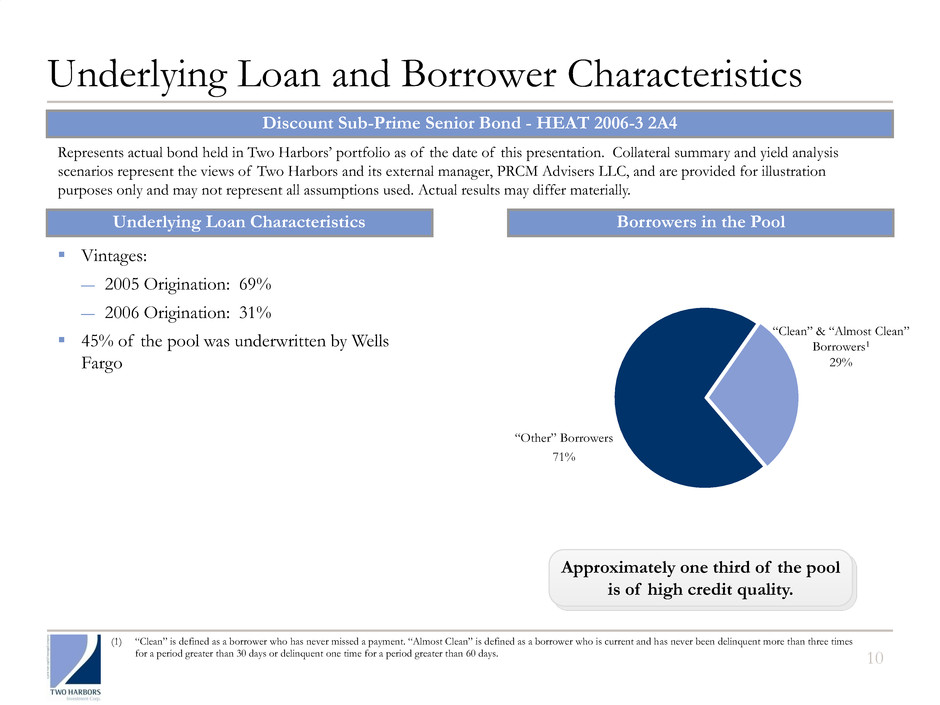

Discount Sub-Prime Senior Bond - HEAT 2006-3 2A4 Underlying Loan and Borrower Characteristics 10 Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Borrowers in the Pool Underlying Loan Characteristics Vintages: ― 2005 Origination: 69% ― 2006 Origination: 31% 45% of the pool was underwritten by Wells Fargo “Clean” & “Almost Clean” Borrowers1 29% “Other” Borrowers 71% Approximately one third of the pool is of high credit quality. (1) “Clean” is defined as a borrower who has never missed a payment. “Almost Clean” is defined as a borrower who is current and has never been delinquent more than three times for a period greater than 30 days or delinquent one time for a period greater than 60 days.

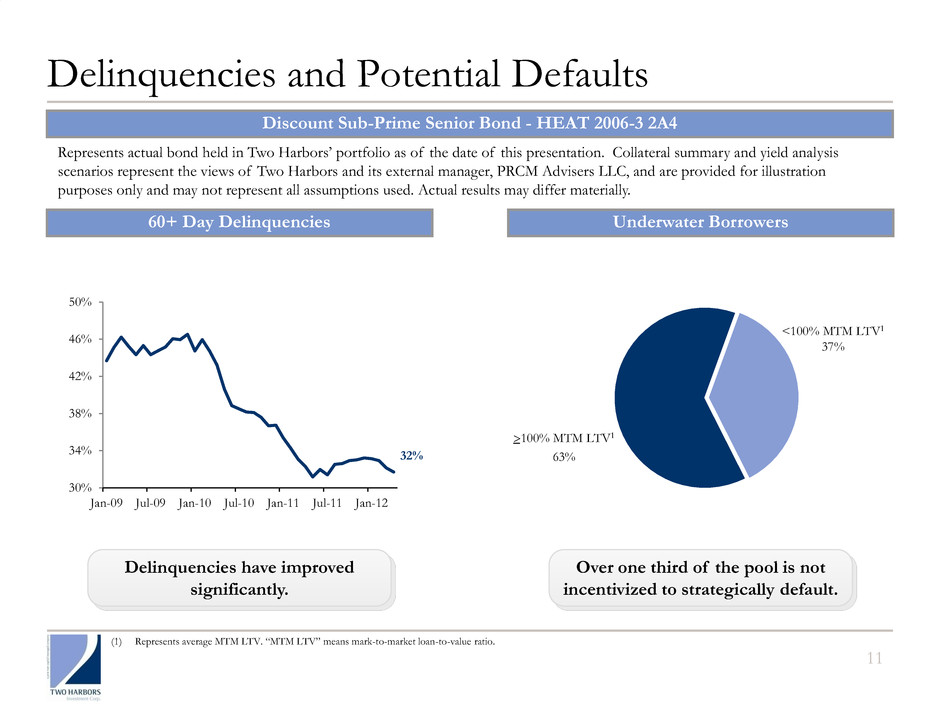

Discount Sub-Prime Senior Bond - HEAT 2006-3 2A4 Delinquencies and Potential Defaults 11 Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Underwater Borrowers 60+ Day Delinquencies Delinquencies have improved significantly. 30% 34% 38% 42% 46% 50% Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 <100% MTM LTV1 37% >100% MTM LTV1 63% Over one third of the pool is not incentivized to strategically default. 32% (1) Represents average MTM LTV. “MTM LTV” means mark-to-market loan-to-value ratio.

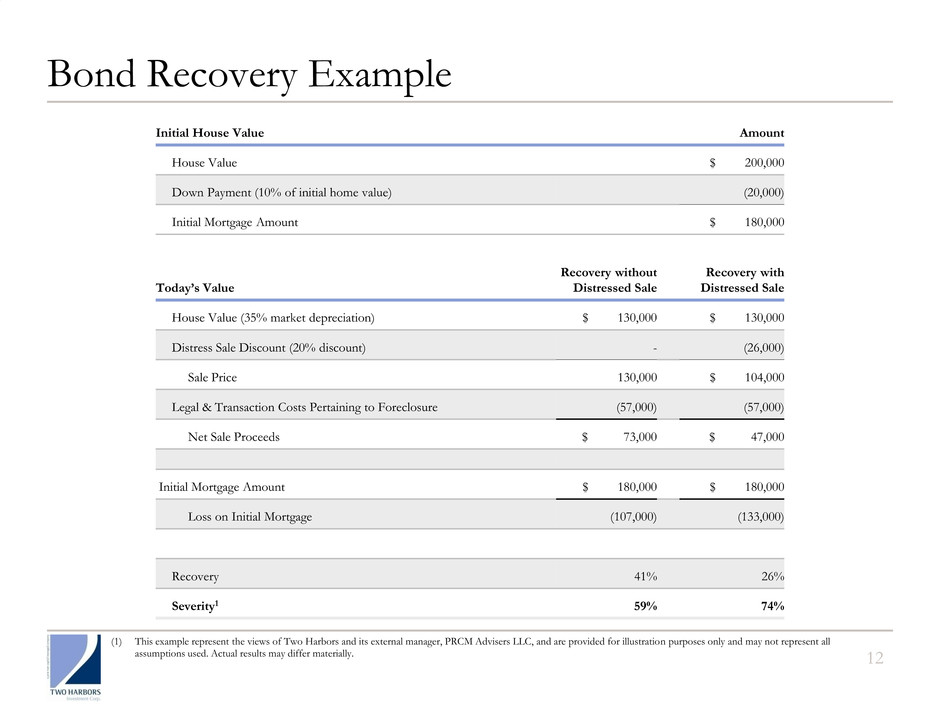

12 Bond Recovery Example Initial House Value Amount House Value $ 200,000 Down Payment (10% of initial home value) (20,000) Initial Mortgage Amount $ 180,000 Today’s Value Recovery without Distressed Sale Recovery with Distressed Sale House Value (35% market depreciation) $ 130,000 $ 130,000 Distress Sale Discount (20% discount) - (26,000) Sale Price 130,000 $ 104,000 Legal & Transaction Costs Pertaining to Foreclosure (57,000) (57,000) Net Sale Proceeds $ 73,000 $ 47,000 Initial Mortgage Amount $ 180,000 $ 180,000 Loss on Initial Mortgage (107,000) (133,000) Recovery 41% 26% Severity1 59% 74% (1) This example represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially.

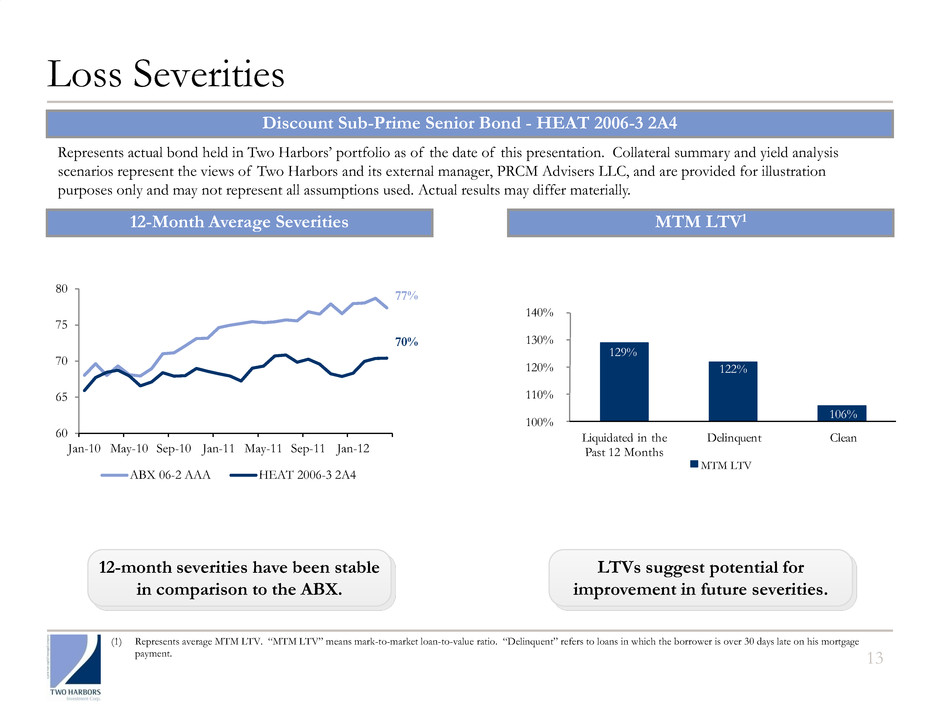

Discount Sub-Prime Senior Bond - HEAT 2006-3 2A4 Loss Severities 13 Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. MTM LTV1 12-Month Average Severities LTVs suggest potential for improvement in future severities. 12-month severities have been stable in comparison to the ABX. 129% 122% 106% 100% 110% 120% 130% 140% Liquidated in the Past 12 Months Delinquent Clean MTM LTV (1) Represents average MTM LTV. “MTM LTV” means mark-to-market loan-to-value ratio. “Delinquent” refers to loans in which the borrower is over 30 days late on his mortgage payment. 60 65 70 75 80 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 ABX 06-2 AAA HEAT 2006-3 2A4 70% 77%

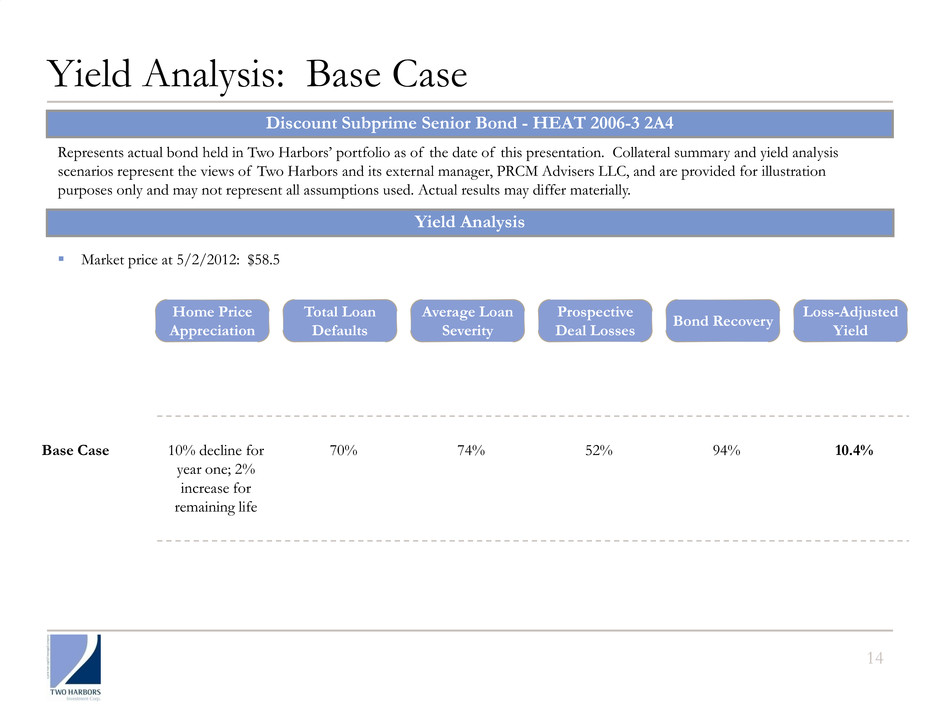

Discount Subprime Senior Bond - HEAT 2006-3 2A4 Yield Analysis: Base Case Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Yield Analysis Home Price Appreciation Total Loan Defaults Average Loan Severity Prospective Deal Losses Bond Recovery Loss-Adjusted Yield Market price at 5/2/2012: $58.5 10% decline for year one; 2% increase for remaining life 70% 74% 52% 94% 10.4% Base Case 14

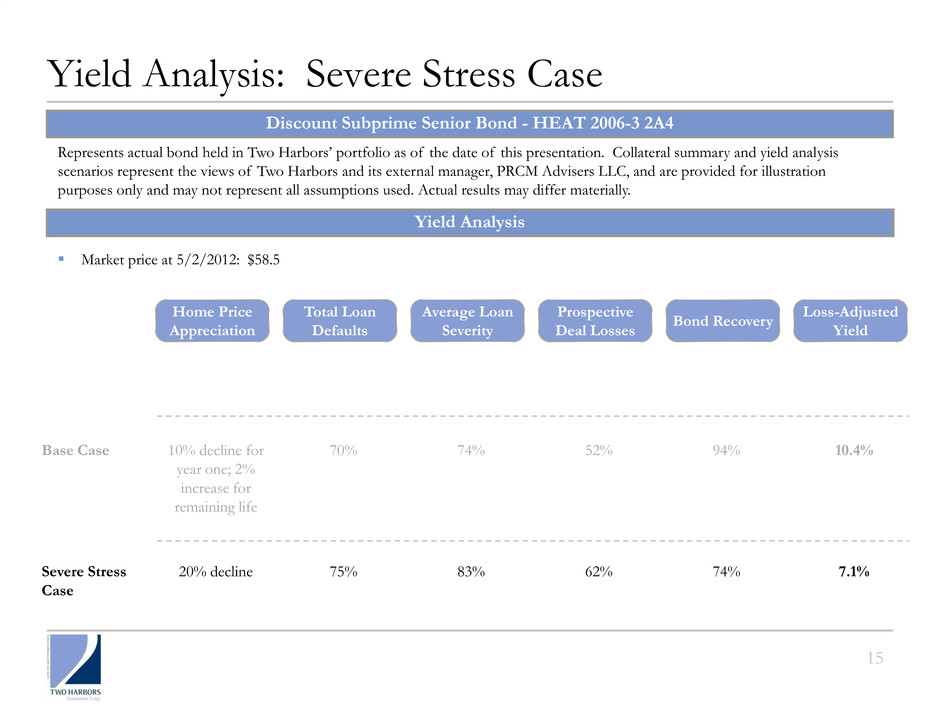

Discount Subprime Senior Bond - HEAT 2006-3 2A4 Yield Analysis: Severe Stress Case Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Yield Analysis Home Price Appreciation Total Loan Defaults Average Loan Severity Prospective Deal Losses Bond Recovery Loss-Adjusted Yield Market price at 5/2/2012: $58.5 10% decline for year one; 2% increase for remaining life 70% 74% 52% 94% 10.4% Base Case 20% decline 75% 83% 62% 74% 7.1% Severe Stress Case 15

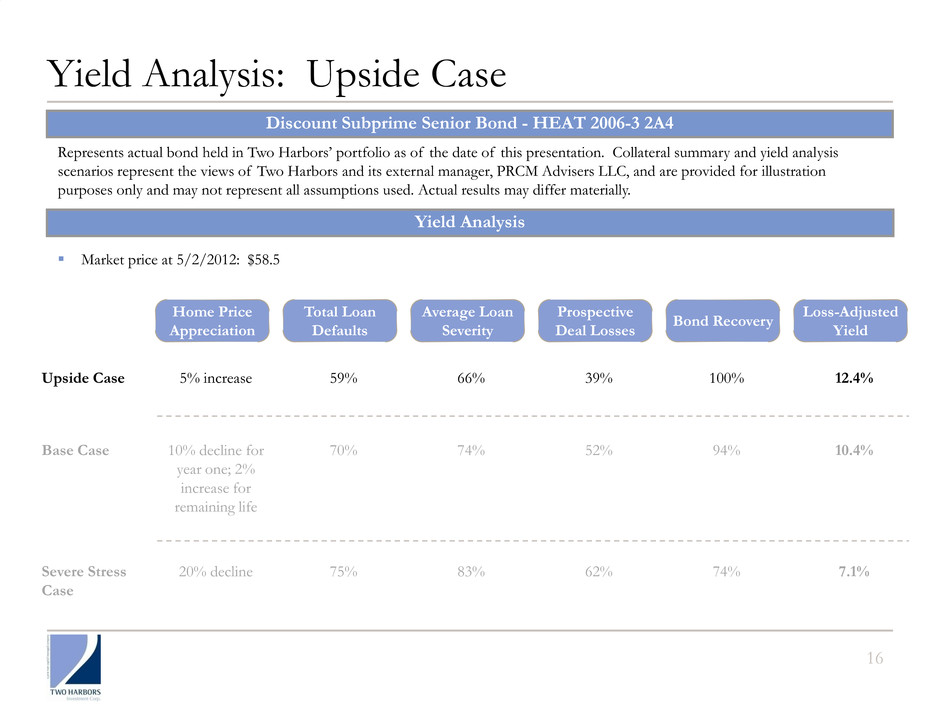

Discount Subprime Senior Bond - HEAT 2006-3 2A4 Yield Analysis: Upside Case Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Yield Analysis Home Price Appreciation Total Loan Defaults Average Loan Severity Prospective Deal Losses Bond Recovery Loss-Adjusted Yield Market price at 5/2/2012: $58.5 10% decline for year one; 2% increase for remaining life 70% 74% 52% 94% 10.4% Base Case 5% increase 59% 66% 39% 100% 12.4% Upside Case 20% decline 75% 83% 62% 74% 7.1% Severe Stress Case 16

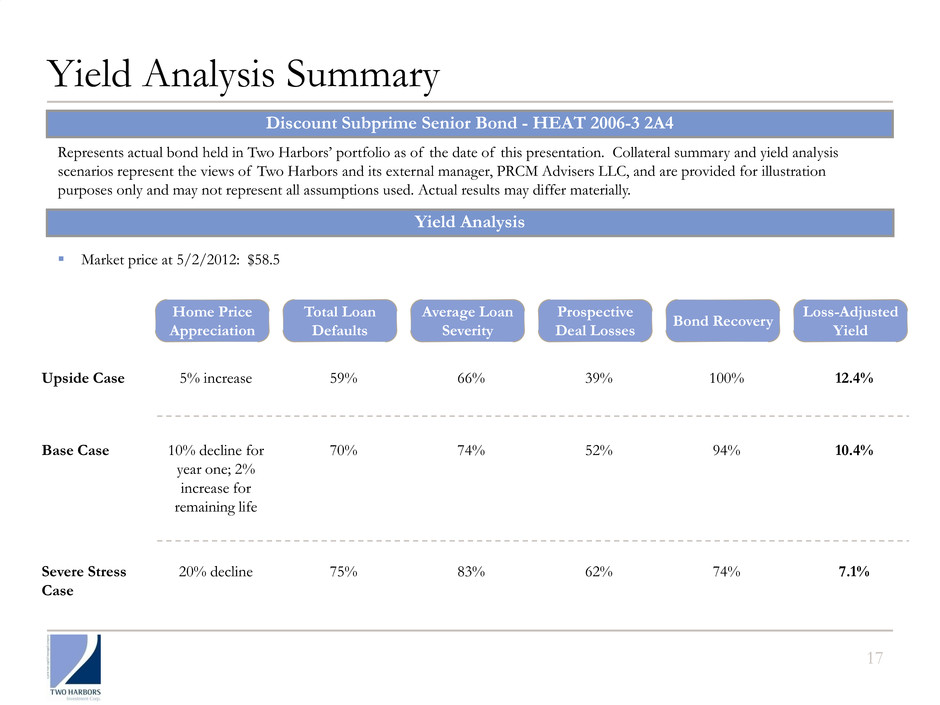

Discount Subprime Senior Bond - HEAT 2006-3 2A4 Yield Analysis Summary Represents actual bond held in Two Harbors’ portfolio as of the date of this presentation. Collateral summary and yield analysis scenarios represent the views of Two Harbors and its external manager, PRCM Advisers LLC, and are provided for illustration purposes only and may not represent all assumptions used. Actual results may differ materially. Yield Analysis Home Price Appreciation Total Loan Defaults Average Loan Severity Prospective Deal Losses Bond Recovery Loss-Adjusted Yield Market price at 5/2/2012: $58.5 10% decline for year one; 2% increase for remaining life 70% 74% 52% 94% 10.4% Base Case 5% increase 59% 66% 39% 100% 12.4% Upside Case 20% decline 75% 83% 62% 74% 7.1% Severe Stress Case 17

18 Summary Sub-prime sector currently presents attractive opportunities on a loss-adjusted basis. ▪ The sub-prime sector functions like a distressed market. We believe the mispricing of credit risk presents an opportunity for investors with strong expertise in credit analysis. ▪ Subordination and excess spread built into the capital structure can provide sub-prime bonds protection against substantial losses on the underlying loans. ▪ Our investment in sub-prime is not purely a valuation play. We believe these bonds provide attractive loss-adjusted yields against a backdrop of improving loan performance. ▪ Sub-prime bonds provide us the opportunity to apply what we believe are severe assumptions that stress test well in a scenario involving a further housing market downturn.

19 For further information, please contact: Christine Battist Investor Relations Two Harbors Investment Corp. 612.629.2507 Christine.Battist@twoharborsinvestment.com Contact Information Anh Huynh Investor Relations Two Harbors Investment Corp. 212.364.3221 Anh.Huynh@twoharborsinvestment.com