Two Harbors Investment Corp. Investor Presentation Capitol Acquisition Corp. June 2009 |

Filed by Two Harbors Investment Corp. pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Capitol Acquisition Corp.

Commission File No.: 001-33769

Two Harbors Investment Corp. Investor Presentation Capitol Acquisition Corp. June 2009 |

2 Two Harbors Investment Corp. Safe Harbor Statement THIS PRESENTATION IS BEING PRESENTED BY CAPITOL ACQUISITION CORP. (“CAPITOL”

OR “CLA”), PINE RIVER CAPITAL MANAGEMENT (“PINE RIVER”) AND TWO HARBORS INVESTMENT CORP. (“TWO HARBORS”). NEITHER CAPITOL, TWO HARBORS NOR ANY OF ITS RESPECTIVE AFFILIATES MAKES ANY

REPRESENTATION OR WARRANTY AS TO THE ACCURACY OR COMPLETENESS OF THE

INFORMATION CONTAINED IN THIS PRESENTATION. THE SOLE PURPOSE OF THIS PRESENTATION IS TO ASSIST PERSONS IN DECIDING WHETHER THEY WISH TO PROCEED WITH A FURTHER REVIEW OF THE PROPOSED TRANSACTION DISCUSSED HEREIN AND IS NOT

INTENDED TO BE ALL-INCLUSIVE OR TO CONTAIN ALL THE INFORMATION THAT A

PERSON MAY DESIRE IN CONSIDERING THE PROPOSED TRANSACTION DISCUSSED HEREIN. IT IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE PROPOSED

TRANSACTION. CAPITOL INTENDS TO FILE A PROXY STATEMENT AND TWO HARBORS INTENDS TO FILE A

REGISTRATION STATEMENT, IN EACH CASE, THAT WILL CONTAIN A PROXY STATEMENT/PROSPECTUS, WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”)

IN CONNECTION WITH THE PROPOSED TRANSACTION. AS PART OF THE PROPOSED TRANSACTION, AN AFFILIATE OF CLA’S OFFICERS, DIRECTORS AND AFFILIATES

WILL BE PROVIDING CERTAIN SERVICES TO TWO HARBORS’ MANAGER AFTER THE

TRANSACTION AND WILL RECEIVE FROM TWO HARBORS’ MANAGER A PERCENTAGE OF THE MANAGEMENT FEES TO BE PAID BY TWO HARBORS. STOCKHOLDERS AND WARRANT HOLDERS OF CLA ARE URGED TO READ THE PROXY STATEMENT AND PROSPECTUS WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PERSONS CAN ALSO READ CLA’S FINAL PROSPECTUS, DATED NOVEMBER 8, 2007, ITS ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008 (THE “ANNUAL REPORT”) AND OTHER REPORTS AS

FILED WITH THE SEC, FOR A DESCRIPTION OF THE SECURITY HOLDINGS OF CLA’S OFFICERS AND DIRECTORS AND THEIR AFFILIATES AND THEIR OTHER RESPECTIVE INTERESTS IN

THE SUCCESSFUL CONSUMMATION OF THE PROPOSED TRANSACTION. THE

DEFINITIVE PROXY STATEMENT/PROSPECTUS WILL BE MAILED TO STOCKHOLDERS AND WARRANT HOLDERS, AS THE CASE MAY BE, AS OF A RECORD DATE TO BE ESTABLISHED FOR VOTING ON THE PROPOSED TRANSACTION. FREE COPIES OF THESE

DOCUMENTS CAN ALSO BE OBTAINED, WHEN AVAILABLE, AT THE SEC’S INTERNET SITE (http://www.sec.gov). CLA, TWO HARBORS, TWO HARBORS’ EXTERNAL MANAGER AND THEIR RESPECTIVE DIRECTORS

AND EXECUTIVE OFFICERS MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES FOR THE SPECIAL MEETINGS OF CLA’S STOCKHOLDERS AND

CLA’S WARRANT HOLDERS TO APPROVE THE PROPOSED TRANSACTION. INFORMATION ABOUT CLA’S DIRECTORS AND EXECUTIVE OFFICERS IS AVAILABLE IN ITS

ANNUAL REPORT. ADDITIONALLY, THE UNDERWRITERS IN CLA’S INITIAL PUBLIC OFFERING MAY ASSIST CLA IN THESE EFFORTS. THE UNDERWRITERS ARE ENTITLED TO

RECEIVE DEFERRED UNDERWRITING COMPENSATION UPON COMPLETION OF THE PROPOSED TRANSACTION. ADDITIONAL INFORMATION REGARDING THE INTERESTS OF

POTENTIAL PARTICIPANTS WILL BE INCLUDED IN THE PROXY STATEMENT AND THE

REGISTRATION STATEMENT AND OTHER MATERIALS TO BE FILED BY CLA AND TWO HARBORS WITH THE SEC. THIS PRESENTATION SHALL NOT CONSTITUTE A SOLICITATION OF A PROXY, CONSENT OR

AUTHORIZATION WITH RESPECT TO ANY SECURITIES OR IN RESPECT OF THE PROPOSED TRANSACTION. THIS PRESENTATION SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN

OFFER TO BUY ANY SECURITIES, NOR SHALL THERE BE ANY SALE OF SECURITIES IN

ANY JURISDICTIONS IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION. NO OFFERING OF SECURITIES SHALL BE

MADE EXCEPT BY MEANS OF A PROSPECTUS MEETING THE REQUIREMENTS OF SECTION

10 OF THE SECURITIES ACT OF 1933, AS AMENDED. |

3 Two Harbors Investment Corp. Forward Looking Statements THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE

SAFE HARBOR PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995. FORWARD-LOOKING STATEMENTS INVOLVE NUMEROUS RISKS AND UNCERTAINTIES. TWO HARBORS’S ACTUAL RESULTS MAY DIFFER FROM ITS EXPECTATIONS, ESTIMATES, AND PROJECTIONS AND, CONSEQUENTLY, YOU SHOULD NOT RELY ON

THESE FORWARD-LOOKING STATEMENTS AS PREDICTIONS OF FUTURE EVENTS. FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL IN NATURE AND CAN BE

IDENTIFIED BY WORDS SUCH AS “ANTICIPATE,” “ESTIMATE,” “WILL,” “SHOULD,” “EXPECT,” “BELIEVE,” “INTEND,” “SEEK,”

“PLAN,” AND SIMILAR EXPRESSIONS OR THEIR NEGATIVE FORMS, OR BY REFERENCES TO STRATEGY, PLANS, OR INTENTIONS. STATEMENTS REGARDING THE FOLLOWING SUBJECTS, AMONG OTHERS, ARE FORWARD-LOOKING BY

THEIR NATURE: THE STATEMENTS (I) REGARDING THE PROPOSED TERMS AND

STRUCTURE OF THE PROPOSED TRANSACTION, THE TERMS OF TWO HARBORS’S SECURITIES UPON COMPLETION OF THE PROPOSED TRANSACTION AND THE PROPOSED TERMS AND STRUCTURE OF TWO HARBORS’S MANAGEMENT AND ORGANIZATION UPON COMPLETION

OF THE PROPOSED TRANSACTION; (II) REGARDING THE ESTIMATED BOOK VALUE OF

TWO HARBORS UPON CLOSING OF THE PROPOSED TRANSACTION; (III) REGARDING TWO HARBORS’S PROPOSED INVESTMENT STRATEGIES AND INVESTMENT GOALS, TARGETED INVESTMENTS AND THE OPPORTUNITIES FOR INVESTMENT; (IV) REGARDING

CERTAIN EXPECTED MARKET TRENDS, INCLUDING THE ROLE PRIVATE CAPITAL IS

EXPECTED TO PLAY IN FINANCING THE RESIDENTIAL MORTGAGE MARKET, THAT THE INCREASED SUPPORT AND INVOLVEMENT OF THE U.S. GOVERNMENT MAY OFFER POTENTIAL FOR ATTRACTIVE NON-RECOURSE FINANCING ALTERNATIVES IMPROVING

INVESTMENT RETURNS, THAT AGENCY RMBS ARE LIKELY TO REMAIN AT LOW PRICES

TO LIBOR FOR SOME TIME, AND THE PROJECTED PREPAYMENT SPEEDS OF CERTAIN ASSETS (INCLUDING THAT SOME PREPAYMENTS ARE LIKELY TO REMAIN SLOWER THAN PROJECTIONS); (V) THAT CERTAIN NON-AGENCY RMBS ARE PRICED AT LEVELS THAT

COMPENSATE FOR CREDIT RISK AND HAVE UPSIDE TO POTENTIAL GOVERNMENT PROGRAMS PROVIDING NON-RECOURSE TERM FINANCING, AND CERTAIN AGENCY RMBS SPREADS

ARE EXPECTED TO REMAIN WIDE; (VI) REGARDING TWO HARBORS’S EXPECTATION TO GENERATE AN ATTRACTIVE ROE; (VII) REGARDING TWO HARBORS’ ABILITY

TO QUICKLY DEPLOY ITS CAPITAL AND THE PRICES AT WHICH AND THE EXTENT TO

WHICH TWO HARBORS WILL INVEST ITS CAPITAL; (VIII) REGARDING TWO HARBORS’S FINANCING STRATEGY AND USE OF LEVERAGE, INCLUDING TWO HARBORS’S TARGET LEVERAGE RATIO AND POTENTIAL USE OF GOVERNMENT PROGRAMS; (IX) REGARDING THE EXPECTED

TERMS OF THE TALF PROGRAM; AND (X) RELATING TO THE WARRANTS AS A

POTENTIAL SOURCE OF CAPITAL GROWTH, INCLUDING THE BOOK VALUE OF TWO HARBORS POST WARRANT EXERCISE AND THE USE OF PROCEEDS BY TWO HARBORS UPON EXERCISE OF THE WARRANTS. THESE FORWARD-LOOKING STATEMENTS ARE SUBJECT TO RISKS AND UNCERTAINTIES.

TWO HARBORS UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD- LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR

OTHERWISE. IMPORTANT FACTORS, AMONG OTHERS, THAT MAY AFFECT ACTUAL RESULTS INCLUDE: UNCERTAINTIES AS TO THE TIMING OF THE PROPOSED TRANSACTION;

APPROVAL OF THE PROPOSED TRANSACTION BY CAC’S STOCKHOLDERS AND WARRANT HOLDERS; THE SATISFACTION OF CLOSING CONDITIONS TO THE PROPOSED TRANSACTION;

COSTS RELATED TO THE PROPOSED TRANSACTION; CHANGES IN ECONOMIC CONDITIONS

GENERALLY, CHANGES IN TWO HARBORS’S INDUSTRY AND CHANGES IN THE COMMERCIAL FINANCE AND THE REAL ESTATE MARKETS SPECIFICALLY; LEGISLATIVE AND REGULATORY CHANGES; AVAILABILITY OF DEBT AND EQUITY CAPITAL TO TWO

HARBORS ON FAVORABLE TERMS, OR AT ALL; AVAILABILITY OF SUITABLE INVESTMENT OPPORTUNITIES THAT SATISFY TWO HARBORS’S INVESTMENT OBJECTIVES AND

STRATEGIES; EXPECTATIONS REGARDING THE TIMING OF GENERATING REVENUES; THE

DEGREE AND NATURE OF TWO HARBORS’S COMPETITION; TWO HARBORS’S DEPENDENCE ON ITS MANAGER AND INABILITY TO FIND A SUITABLE REPLACEMENT IN A TIMELY MANNER, OR AT ALL, IF TWO HARBORS OR ITS MANAGER WERE TO

TERMINATE THE MANAGEMENT AGREEMENT; CHANGES IN THE RELATIONSHIPS AMONG,

OR THE BUSINESS OR INVESTMENT OBJECTIVES AND STRATEGIES OF, AND CONFLICTS OF INTEREST AMONG, TWO HARBORS AND PINE RIVER, INCLUDING THE MANAGER; LIMITATIONS IMPOSED ON TWO HARBORS’S BUSINESS BY ITS EXEMPTIONS UNDER

THE 1940 ACT; CHANGES IN INTEREST RATES AND INTEREST RATE SPREADS; THE PERFORMANCE, FINANCIAL CONDITION AND LIQUIDITY OF BORROWERS; INFLATION; CHANGES IN

GAAP; CHANGES IN PERSONNEL AND LACK OF AVAILABILITY OF QUALIFIED PERSONNEL; MARKET TRENDS; POLICIES AND RULES APPLICABLE TO REITS; AND OTHER FACTORS

NOT PRESENTLY IDENTIFIED. |

4 Two Harbors Investment Corp. Proven Manager with Strong Track Record Capitol Acquisition (NYSE Amex: CLA) to merge with a subsidiary of Two Harbors Investment Corp., a newly created mortgage REIT to capitalize on severe dislocation in residential mortgage backed securities (RMBS) market.

At current CLA price, an investor creates a share in Two Harbors at 1.00x initial Book Value vs. 1.40x trading average for non-Agency public peers. (1) Externally managed by PRCM Advisers, an affiliate of Pine River, a global fixed-income focused asset manager. Since February 2008 inception, Pine River’s MBS strategy has returned

95.6% net (2) with no negative months. Team and infrastructure in place to rapidly invest proceeds and manage future growth. Attractive 1.5% management fee structure with no additional performance fees. Opportunity Transaction Highlights (1) Please see slide 24

entitled “Comparables: Non-Agency and Agency REITS” for more information. (2) For more information

with respect to the performance of Pine River’s MBS strategy including key assumptions used in deriving such performance, please see slide 8 entitled “Pine River’s MBS Strategy Historical Returns”. . |

5 Two Harbors Investment Corp. With no legacy assets, Two Harbors is positioned to invest 100% of Capitol’s trust fund proceeds into RMBS with potential for attractive risk

adjusted returns and Return on Equity (ROE). Cross-product approach targeting all sub-sets of the RMBS market enables

Two Harbors to best capture inefficiencies. Expected government financing programs such as TALF II (1) (if expanded to RMBS) could increase return on equity. Compelling Targeted Returns Transaction Highlights (1) Term Asset-Backed Securities Loan Facility (TALF). (2) As of June 9, 2009 closing price. Capitol’s public shareholders to own 100% of Two Harbors post completion. Expected market capitalization of $252 million based on 26.25 million common shares and current stock price of $9.61 (2) (reduced by the amounts converted by stockholders exercising their conversion rights and the amounts that may be used to enter into forward or other contracts to purchase shares of Capitol). Warrants struck at $11.00 provide accretive growth capital. Pro Forma Ownership |

6 Two Harbors Investment Corp. Experienced, Cohesive Team: Six partners together for average of 14 years. – Average 18 years hedge fund experience. 54 employees, 19 investment professionals. No senior management turnover. Historically low attrition. Overview of Pine River Capital Management Founded June 2002 with offices in New York, London, Hong Kong, San Francisco and

Minnesota. Over $800 million assets under management (1) . – Experienced manager of non-Agency, Agency and other mortgage related

assets. – Pine River has never suspended or withheld cash from investors. Established Infrastructure: Strong corporate governance. Registrations: SEC/NFA (U.S.), FSA (U.K.), SFC (Hong Kong), SEBI (India) and TSEC (Taiwan). Proprietary technology. Global footprint. Minnetonka,

MN • London • Hong Kong • San

Francisco • New York Global multi-strategy asset management firm providing comprehensive

portfolio management, transparency and liquidity to institutional and

high net worth investors. (1) Estimate as of June 1, 2009. |

7 Two Harbors Investment Corp. The Two Harbors Team Board consists of seven directors, majority independent, including: – Chairman, Brian Taylor, CEO and Founder, Pine River; – Vice-Chairman, Mark Ein, CEO, Capitol; – Director, Tom Siering, Partner, Pine River; and – Four independent directors. Tom Siering, CEO. Jeff Stolt, CFO. Steve Kuhn, Co-Chief Investment Officer. Bill Roth, Co-Chief Investment Officer. Tim O’Brien, General Counsel. Andrew Garcia, VP Business Development. Management Team Board of Directors |

8 Two Harbors Investment Corp. Pine River’s MBS Strategy Historical Returns Jan-08 Feb-08 Mar-08 Apr-08 May-08 Jun-08 Jul-08 Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Net Monthly Return N/A 2.93% 1.26% 2.83% 4.10% 4.09% 2.49% 2.11% 9.56% 2.46% 3.26% 4.32% Net Annual Return N/A 2.93% 4.23% 7.18% 11.57% 16.13% 19.02% 21.52% 33.15% 36.42% 40.87% 46.95% Jan-09 Feb-09 Mar-09 Apr-09 May-09 (Estimate) Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Net Monthly Return 8.50% 5.01% 4.48% 5.09% 6.38% Net Annual Return 8.50% 13.94% 19.04% 25.10% 33.08% Annualized Net Life to Date Return 3 Month Net Return Annualized Standard Deviation 6 Month Net Return Positive Months 12 Month Net Return LTD Net Return Nisswa Fixed Income Fund L.P. Estimated May 1, 2009 Assets Under Management 95.56% 16.80% 38.82% 75.28% 65.37% 7.84% 16/16 $202.2 Million Beginning in September 2008, the data reflects the actual performance of Nisswa Fixed

Income Fund L.P. For the period from February 2008 to August 2008, Pine River’s fixed income

strategy was conducted through Nisswa Master Fund Ltd., a multi-strategy hedge fund that focuses on both investment grade and non-investment grade global convertible arbitrage, capital structure

arbitrage, SPAC warrant arbitrage and fixed income arbitrage. The performance data included above for this period reflects the performance of this strategy as a component of Nisswa Master Fund Ltd. The

performance information relating to this strategy is derived from the strategy attribution contained in the monthly investor reports of Nisswa Master Fund Ltd. which separately reported on the results of this

strategy, except that the performance information shown above reflects the payment of full incentive fees to the manager, even if such fees were not paid. The strategy performance information is based

on a number of important assumptions with respect to the allocation of leverage, stock loan fees and interest income and expenses. For example, Pine River allocated fund leverage and expenses among

Nisswa Master Fund Ltd.’s various strategies based on margin requirements across the positions in each strategy. Investors should note that the investment strategy of each of Nisswa Fixed Income

Fund L.P. and the fixed income strategy component of Nisswa Master Fund Ltd. is different from the investment strategy that Two Harbors intends to employ in several important respects. Nisswa Fixed

Income Fund L.P. (and before September 2008 the fixed income strategy component of Nisswa Master Fund Ltd.) traded actively in fixed-rate, adjustable and interest only securities, Collateralized

Mortgage Obligations, trades in mortgage backed securities to be delivered by a U.S. government-sponsored mortgage entity at a future date, and equity investments in REITs, and actively hedged its trading

positions. However, Two Harbors initially expects to invest predominately in Agency and non-Agency RMBS with a buy-and- hold emphasis. In addition, whereas Nisswa Master Fund Ltd. and Nisswa Fixed

Income Fund L.P. charge a 1.5% management fee as well as a 20% incentive fee, Two Harbors will only pay a 1.5% management fee. Two Harbors investment strategy may differ from that of Nisswa

Fixed Income Fund L.P. additionally, in that it intends to use greater leverage with regard to its investments in Agency securities. Accordingly investors should not assume that they will experience

returns, if any, comparable to those experienced by investors in Nisswa Fixed Income Fund L.P. or the fixed income strategy component of the Nisswa Master Fund Ltd. Past performance is not indicative of future results. Return on capital is

calculated based on average monthly capital, not beginning of month capital. Assumes a 1.5% management fee and 20% incentive fee. |

9 Two Harbors Investment Corp. Two Harbors Investment Approach Holistic approach across non-Agency and Agency RMBS. Continuous top-down market assessment to identify most attractive segments. Detailed analyses to find the most mispriced securities. Find and invest in smaller opportunities often ignored by larger funds. Strong focus on risk management to preserve value and maximize returns. |

10 Two Harbors Investment Corp. Market Opportunity Traditional providers of capital have left the market. – Fannie Mae & Freddie Mac, historically the overseers of relative value and effectively the world’s two largest mortgage “hedge funds”, cannot

participate in the current price discrepancies. – The capital bases of traditional market participants such as proprietary trading

desks and hedge funds have been reduced. Continued forced selling by remaining participants has led to significant price

declines. Two Harbors will be positioned to capitalize upon severe

dislocations in the $11.0 trillion U.S. mortgage market. (1) (1) FBR Miller. |

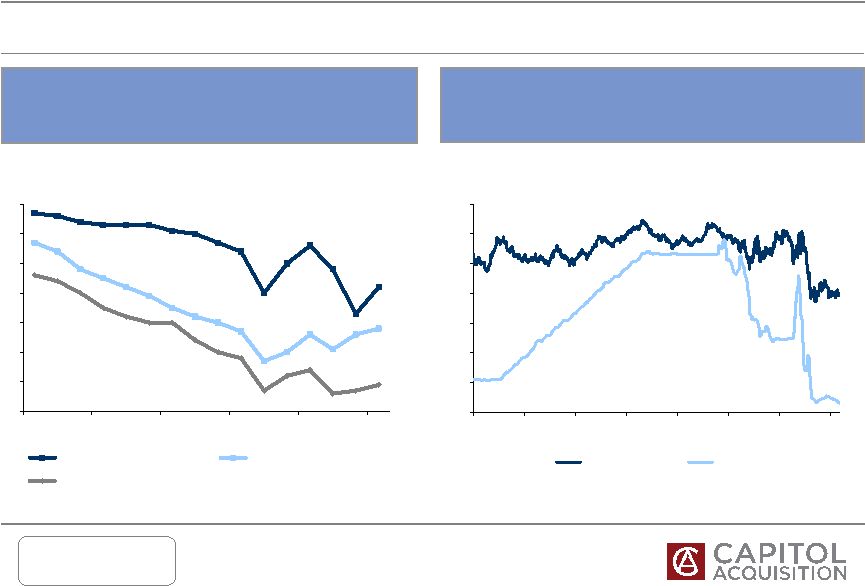

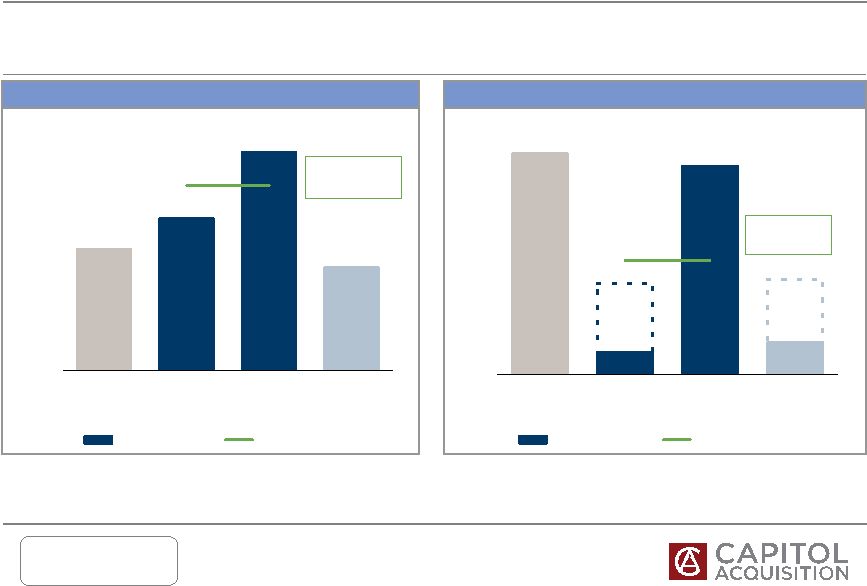

11 Two Harbors Investment Corp. 0% 1% 2% 3% 4% 5% 6% 7% Jan-04 Oct-04 Jul-05 Apr-06 Jan-07 Oct-07 Jul-08 Apr-09 FN30CC 1moLIB Agency securities are trading at wide spreads to LIBOR and are likely to remain wide for some time. Source: UBS Mortgage Strategy. Non-Agency securities are trading at low prices. Significant opportunities in both non-Agency and Agency securities. Source: Amherst Securities. Note: All prices are indicative month-end levels for 2006 / 2007 vintages. Historical Pricing on Senior Non-Agency Securities Agency Spreads FN 30-yr Current Coupon vs. LIBOR 30 40 50 60 70 80 90 100 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Prime - 30 Year Fixed Alt - A - 30 Year Fixed Option Arm Super Senior Market Opportunity |

12 Two Harbors Investment Corp. (1) Actual results will be impacted by the risks inherent in any mortgage backed

securities portfolio, including by the matters discussed in the Proxy Statement/Prospectus under "Risk Factors." Investors are urged to read this document in its entirety when available, including the section under "Risk Factors.” Assumes no shareholder conversions. (2) Haircut is defined as the percent of market value one must pledge as collateral to

finance a security. (3) The following assumptions were used for each security type: Agency Hybrids: 15

Constant Prepayment Rate (CPR); Non-Agency Super Senior: 1 CPR, 30 Constant Default Rate (CDR), 70 Loss Severity; Non-Agency Mezzanine: 4 CPR, 15 CDR, 70 Loss Severity; MBS Derivatives: 25 CPR. (4) Assumes 9x borrowings. (5) Assumes LIBOR is flat to current level. Hypothetical Portfolio Hypothetical Portfolio (1) % of Equity Finance Interest Interest Return on Security Type Low Mid High Equity Haircut Assets Yield Rate Income Expense Equity Agency hybrids 15% 20% 25% $50.2 10% $502.1 4% 1.0% $20.1 ($4.5) 31.0% Non-Agency super senior 35% 45% 55% 113.0 100% 113.0 16% – 18.1 – 16.0% Non-Agency mezzanine 10% 20% 30% 50.2 100% 50.2 30% – 15.1 – 30.0% MBS derivatives 5% 15% 25% 37.7 100% 37.7 40% – 15.1 – 40.0% 100% $251.1 $703.0 $68.3 ($4.5) 25.4% Estimated shareholder equity: $251.1 Total leverage: 1.8x (4) (3) (5) ($ in millions) (2) In the discussions leading up to the execution of the merger agreement, Two Harbors

presented the following hypothetical portfolio information to the Board of Directors of Capitol for its consideration and review. Such hypothetical portfolio information does not

represent any actual assets held or borrowings made by Two Harbors. Instead, the presentation illustrates the types and performance characteristics of a portfolio of assets that Two Harbors believes should

be available for purchase in the market and illustrates the costs of borrowings that Two Harbors believes should be available upon completion of the merger. There can be no assurance that a

portfolio of the type presented will be available for purchase upon consummation of the merger at the prices assumed. In addition, the returns from the portfolio are based on a number of assumptions

detailed below. Actual results will vary from the amounts shown in the presentation below. |

13 Two Harbors Investment Corp. Non-Agency Discount Example Super Senior Bond backed by Option Arm Collateral (CWALT 2006-OA17 2A1). – First 27.8% of loss is absorbed by junior bonds. – Receives protection from the Senior Support and Subordinate bonds from credit losses. – Pays a coupon of COFI (2) + 150bps, where most Option Arms pay 1mo Libor + a smaller margin. SUPER SENIOR BONDS 27.8%-100% Illustrative non-Agency Security Investment SUPPORT BONDS Voluntary CPR (1) of 1, which implies only 1% of the people in the trust (annually) will be able to refinance. A constant default rate of 35, which means 35% of the trust per year will be defaulted. Loss severity of 70%, which assumes all loan liquidated out of the trust will trade for 30 cents on the dollar. Purchase price: $34.00. Yield: 18.5 percent. Security Assumptions Risk / Reward Profile of this Bond (1) Constant prepayment rate. (2) Other assumptions: 1% voluntary CPR, 30 CDR, Cost of Funds Index (“COFI”) flat at 1.38%. Dollar Price 50% 55% 60% 65% 70% 75% $34 44.0% 37.0% 31.0% 25.0% 18.0% 12.0% Yields at Various Loss Severity Assumptions (2) Implied liquidation % of the entire pool: over 95 percent. Implied total % loss on the collateral: 66.7 percent. This bond does not represent an actual asset held by Two Harbors. Instead, the

presentation illustrates the analysis PRCM Advisors expects to perform in analyzing potential bonds for purchase by Two Harbors. There can be no assurance that an asset of the type

presented will be available for purchase upon consummation of the merger at the assumed price, or at all. |

14 Two Harbors Investment Corp. The TALF Program – Potential Catalyst Currently available for select Asset Backed and Commercial Mortgage Backed

securities. Treasury has proposed expansion to include “certain

non-Agency residential mortgage backed securities”. (1) Key loan aspects expected to include: – Non-recourse financing; – Possible terms of up to 5-years (2) ; – Haircuts and spreads based on average life and type of asset; and – Reduced spreads on loans benefiting from government guarantees. Non-recourse term financing, such as that contemplated by TALF II, could have an

impact on expected Return on Equity. (1) The timing of the expansion of the TALF to Non-Agency RMBS and the terms of such

expansion have not yet been published by the U.S. Treasury. There can be no assurance that TALF will be so expanded or if so expanded that TALF will offer financing terms that will be attractive to Two

Harbors. (2) If TALF were expanded to RMBS, this assumes the term would follow the TALF expansion to CMBS. |

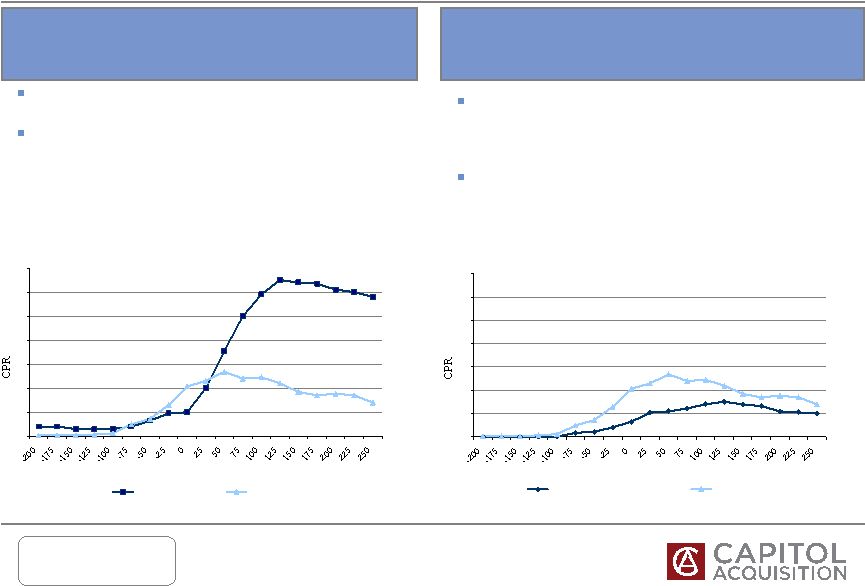

15 Two Harbors Investment Corp. 0 10 20 30 40 50 60 70 Incentive to Prepay in bps (May 2009) LLB Generic 0 10 20 30 40 50 60 70 Incentive to Prepay in bps 2003 2009 May Source: Merrill Lynch Fixed Income Strategy and J.P. Morgan Securities Inc. Capacity constraints of mortgage originators. Significant declines in homeowners equity reduces borrower’s ability to access funding. Low Loan Balance (LLB) – Fixed costs reduce borrower’s incentive; busy brokers avoid low-fee business. Fixed costs represent higher barriers to smaller borrowers. Prepayment speeds remain slower than 2003 despite government intervention. Some prepayments likely to remain slower than projections. Prepayment Cycle Creates Pricing Opportunities Fannie 30-yr. Prepayment Curves Fannie 30-yr Prepayment Curves by Loan Attributes |

16 Two Harbors Investment Corp. Agency Inverse IO Example Agency Inverse IO bonds are an inherently levered way to take advantage of slow

prepayment speeds on specific types of collateral pools, such as

LLBs. 5 CPR 15 CPR 25 CPR 35 CPR 45 CPR 53 CPR Price 10-03 61.0% 53.0% 45.0% 31.0% 14.0% (1.0%) Yields at Various Prepayment Speeds Agency Inverse IO Bond Example Loan Size Data (as of April 2009) Average Original Original Current Minimum Maximum $68,300 $64,900 $21,000 $85,000 1 month May-09 18.6 Apr-09 14.4 Mar-09 18.4 Feb-09 13.2 Jan-09 8.1 Dec-08 5.6 Nov-08 9.3 Oct-08 8.1 Sep-08 7.2 Aug-08 8.4 Jul-08 13.9 Jun-08 16.5 Constant Prepayment Rates (CPRs) This bond does not represent an actual asset held by Two Harbors. Instead, the

presentation illustrates the analysis PRCM Advisors expects to perform in

analyzing potential bonds for purchase by Two Harbors. There can be

no assurance that an asset of the type presented will be available for purchase upon consummation of the merger at the assumed price, or at all. |

17 Two Harbors Investment Corp. Supported by 35 operational and administrative professionals, including: – 11 member accounting team; – 3 member legal team; – 7 member operations and settlement team; and – 6 member software development team. Pine River Offers Extensive MBS Expertise Two Harbors’ Co-Chief Investment Officers Steve Kuhn – Partner and Head of Fixed Income Trading. – Goldman Sachs Portfolio Manager from 2002 to 2007. – 16 years investing in and trading mortgage backed securities and other fixed income securities for firms including Goldman Sachs Asset Management, Citadel and

Cargill. Bill Roth – Portfolio Manager (beginning June 16, 2009). – Citi and Salomon Brothers 1981 – 2009; Managing Director since 1997. – Managing Director in the bank’s proprietary trading group managing MBS and ABS

portfolios. Pine River’s Mortgage Backed strategy has returned 95.6% net of fees since

inception, February 2008. (1) Jiayi Chen – Trader. – Formerly Goldman Sachs Asset Management, risk management. Brendan McAllister – Trader. – Formerly UBS Securities, member of top mortgage sales team. Diana Denhardt – Repo Funding Analyst. – 20 years financing experience at EBF & Associates and Cargill. (1) For more information with respect to the performance of Pine River’s MBS strategy including key assumptions used in deriving such performance, please see slide 8 entitled “Pine River’s MBS Strategy Historical Returns”. |

18 Two Harbors Investment Corp. Two Harbors Investment Team Goals Create highest return on equity in the mortgage REIT sector. Capture significant capital appreciation resulting from government policies, including if TALF is expanded to cover RMBS. Maintain investment flexibility across entire RMBS sector to best take advantage of opportunities as the mortgage market evolves.

|

19 Two Harbors Investment Corp. Opportunity for Investors $2.6 Cash and Cash Equivalents $9.56 Initial Book Value Per Share (2) Valuation Summary ($ in millions, except per share amounts) June/July 2009 $251.1 Initial Book Value 1.00x Assumed Price/Initial Book Value $10.6 Less: Estimated Transaction & Other Expenses Note: Balance sheet as of March 31, 2009, balances and estimates subject to change.

(1) As of June 9, 2009. (2) Assumes 100% of sponsors’ promote shares retired and existing 33.2 million warrants amended to an

out-of-the-money strike price of $11.00. 26.25 Fully Diluted Shares (treasury method) $252.3 Fully Diluted Equity Value $259.1 Add: Cash Held in Trust $9.61 Assumed Price Per Share (1) Capitol’s common stockholders expected to create Two Harbors at or near Book

Value. Estimated Value at Closing |

20 Two Harbors Investment Corp. 124% 109% 156% 100% 50.0% 70.0% 90.0% 110.0% 130.0% 150.0% 170.0% Agency REIT Mean Chimera Investment Corp Redwood Trust Two Harbors Non-Agency REIT's Non-Agency REIT Mean Non-Agency Mean: 140% 1.0x 6.6x 7.0x 0.7x – 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x Agency REIT Mean Chimera Investment Corp Redwood Trust Two Harbors Non-Agency REIT's Non-Agency REIT Mean Non-Agency Mean: 3.6x 3.0x 2.9x Efficient structure creates Two Harbors at a lower Price to Book Value, using less leverage than other publicly traded residential mortgage REITs. Target Leverage Price to Book Value Opportunity for Investors Note: Agency REIT Mean comprised of American Capital Agency, Annaly Mortgage, Anworth Mortgage, Capstead Mortgage, Hatteras Financial and MFA Mortgage. Non-Agency REIT Mean comprised of Chimera Investment Corp. and Redwood

Trust. Prices as of June 9, 2009. (1) Target Leverage defined here as Total Liabilities divided by Total Equity. (2) Current leverage of 0.7x pro forma for recent equity offerings. Unadjusted for the

equity offerings, target leverage would be 2.9x. (3) Current leverage of 6.6x pro forma for recent equity offering. Unadjusted for the

equity offering, target leverage would be 9.6x. (2) (2) (3) (3) (1) |

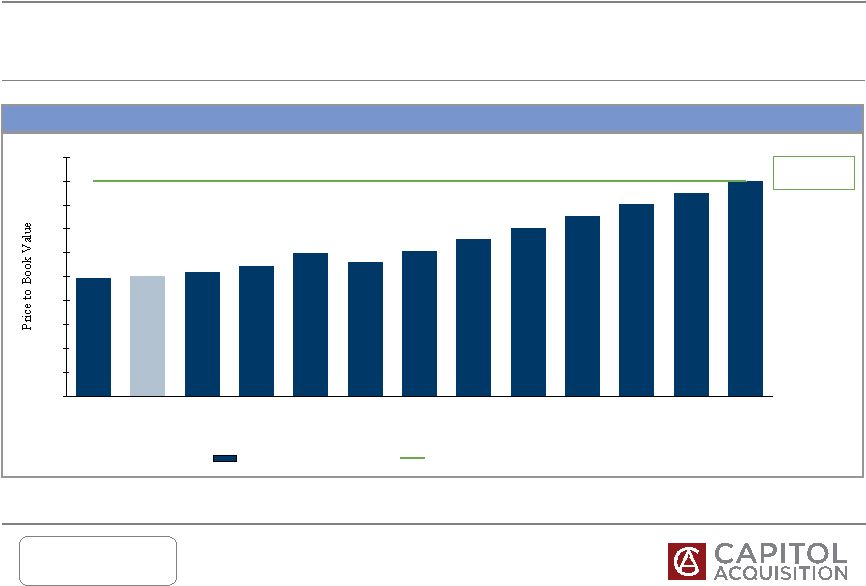

21 Two Harbors Investment Corp. 0.5x 0.6x 0.7x 0.8x 0.9x 1.0x 1.1x 1.2x 1.3x 1.4x 1.5x $9.50 $9.61 $9.75 $10.00 $10.50 $11.00 $11.50 $12.00 $12.50 $13.00 $13.50 $14.00 $14.50 Common Price Two Harbors Price to BV Non-Agency REIT Mean Price to BV Price to Book Value Transaction expected to create Two Harbors closer to Book Value than would be possible

in a traditional IPO or through secondary market purchases. Opportunity for Investors Note: Assumes 100% of sponsors’ promote shares retired and existing 33.2 million warrants amended to an

out-of-the-money strike price of $11.00. Non-Agency

Mean: 1.40x |

22 Two Harbors Investment Corp. Structure Creates Attractive Return Profile Severe dislocation has led to capital outflows and potential investment opportunities throughout the sector. Government programs to inject liquidity into market provides additional upside. Deep, broad experience and disciplined investment approach. Generated 95.6% (1) return and no negative return months since Steve Kuhn launched Pine River’s MBS strategy in February 2008. CLA’s public stockholders expected to create Two Harbors at 1.00x initial Book Value vs. 1.40x average for non-Agency public peers (2) . High targeted return on equity with moderate leverage. Market Opportunity Investment Team Investment Summary Building Next Great Mortgage REIT Highly experienced team of mortgage specialists brought together to create next great mortgage REIT franchise. (1) For more information with respect to the performance of Pine River’s MBS strategy

including key assumptions used in deriving such performance, please see slide 8 entitled “Pine River’s MBS Strategy Historical Returns”. (2) Please see slide 24 entitled “Comparables: Non-Agency and Agency REITS” for more information. |

Two Harbors Investment Corp. Appendix |

24 Two Harbors Investment Corp. Comparables: Non-Agency and Agency REITs ($ in millions, except per share data) Price Market Price / Div. Yield: Debt / % Expense Company Ticker 6/9/2009 Cap 2009E EPS 2010E EPS Book Most Recent Equity Agency Ratio Non-Agency REITs Chimera Investment Corp. CIM $3.51 $2,353 8.6x 6.8x 1.24x 9.1% 0.7x 39% 3.4% Redwood Trust RWT 15.00 1,162 30.6 8.3 1.56 6.7 6.6 0 8.3 Mean 19.6x 7.5x 1.40x 7.9% 3.6x 20% 5.9% Agency REITs Annaly Mortgage NLY $14.79 $8,051 6.4x 6.4x 1.01x 13.5% 6.4x 1.5% MFA Mortgage MFA 6.61 1,472 6.5 6.1 1.08 13.3 6.2 1.6 Hatteras Financial HTS 25.83 935 5.7 5.6 1.16 16.3 7.1 1.5 Capstead Mortgage CMO 12.68 805 5.3 5.6 1.23 17.7 8.4 1.8 Anworth Mortgage ANH 6.84 695 5.7 6.1 1.03 17.5 6.7 2.2 American Capital Agency AGNC 20.36 305 5.4 5.9 1.06 16.7 7.3 3.3 Mean 5.8x 5.9x 1.09x 15.8% 7.0x 2.0% Overall Mean 12.7x 6.7x 1.25x 11.9% 5.3x 3.9% (5) (6) (1) (2) (3) (4) (1) Source: SNL Financial, FactSet and company filings. Note: REIT Means calculated using the average of the non-Agency peer group mean and the

Agency peer group mean. Prices as of June 9, 2009. (1) Based on IBES consensus estimates, where available. (2) Most recent announced quarterly dividend annualized, divided by current share price.

(3) Debt / Equity Leverage defined here as Total Liabilities divided by Total Equity.

(4) Expense ratio is all non-interest expense less non-recurring expenses and any

provisions for loan losses divided by end of period total equity for the most recent quarter. (5) Pro forma for recent equity offerings. (6) Pro forma for recent equity offering. |

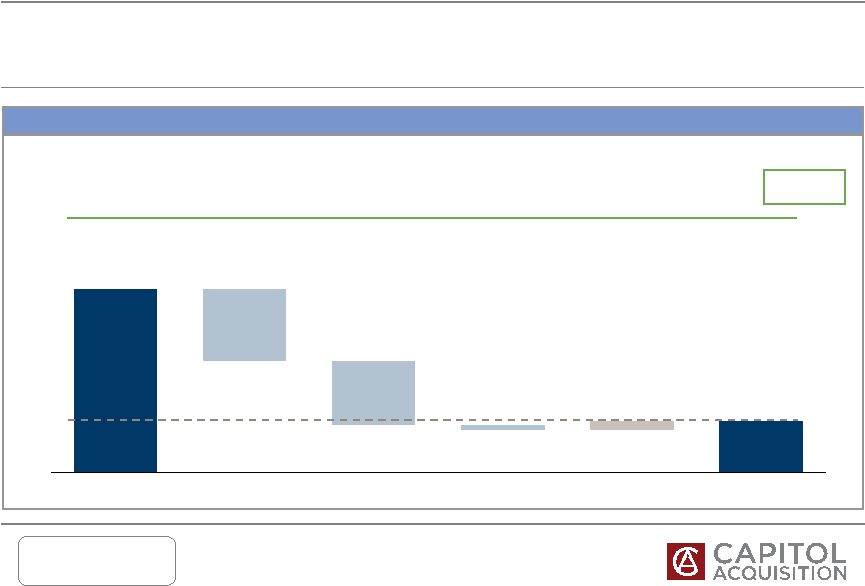

25 Two Harbors Investment Corp. 1.26x 1.00x 0.02x (0.14x) (0.13x) (0.01x) 0.9x 1.0x 1.1x 1.2x 1.3x 1.4x 1.5x Initial Adjust warrants Retire sponsor shares Adjust deferred IPO fees Transaction expenses Final We de-SPAC the SPAC By re-striking warrants at $11.00, retiring the sponsor shares, and restructuring

the deferred fees, we de-SPAC the SPAC. Non-Agency Mean: 1.40x (1) As of June 9, 2009 closing price. (1) Current CLA Share Price Multiple of Book Value

|

26 Two Harbors Investment Corp. Restructured Warrants Source of Growth Capital Consent requires majority of warrant holders. Any cash warrant exercises will be at a premium to the initial liquidation value. Proceeds expected to be redeployed in accretive investments. Note: Assumes re-strike of 33.249 million warrants at $11.00 and exercise of all warrants for cash. However, 7,000,000 warrants each relating

to one share of stock of Two Harbors, which will be held by CLA’s

sponsors following the consummation of the merger, are exercisable on a cashless basis. If these warrants are exercised, the Book Value per Share would be less than $10.37 due to dilution and the greater the price of Two Harbors’ stock price at the time of exercise of these warrants, the greater the dilutive impact. Warrant Exercise ($ in millions, except per share data) Warrant strike price to be amended to $11.00. Pre Post Book Value $251.1 $616.8 Basic Shares Outstanding (mm) 26.25 59.50 Book Value per Share $9.56 $10.37 % Increase 8.4% |

27 Two Harbors Investment Corp. Capitol Shareholder Options Holders of record of CLA stock have the option of receiving a share of Two Harbors or

a pro rata distribution of the cash held in CLA’s trust (currently

$9.87). Capitol Acquisition Shareholder The acquisition is approved If unable to complete a transaction by 11/8/2009, shareholder receives pro rata share of cash-in-trust (currently $9.87). The acquisition is rejected and CLA liquidates in 11/09 Shareholder receives pro rata share of cash-in-trust (currently $9.87). CLA shareholder votes “no” Shareholder holds share of Two Harbors. CLA shareholder votes “yes” |

28 Two Harbors Investment Corp. Experienced Team to Pine River’s inception, Brian was with EBF & Associates from 1988 to 2002;

he was named head of the convertible arbitrage group in 1994 and Partner

in 1997. His responsibilities included portfolio management, marketing, product development, and trading information systems development. He holds a B.S. from Millikin University in Decatur, Illinois and an M.B.A. from the

University of Chicago and passed the Illinois CPA exam. and CEO of Venturehouse Group, LLC, a technology holding company that creates,

invests in and builds technology, communications and related business

services companies. Notable portfolio companies include Matrics Technologies, sold to Symbol Technologies in 2004; Cibernet Corporation, sold to MACH S.a.r.l in 2007; and an early investment in XM Satellite Radio. He

is also the President of Leland Investments, a private investment firm. Mark is also Co-Chairman and majority owner of Kastle Systems, a leading provider

of building and office security systems. Mark is also the Founder and Owner of the Washington Kastles, the World Team Tennis franchise in Washington, D.C.

From 1992 to 1999, Mark was a Principal with The Carlyle Group. Prior to

Carlyle, Mark worked at Brentwood Associates and Goldman, Sachs (in the commercial MBS group). Mark holds a B.S. from the University of Pennsylvania’s Wharton School of Finance and an M.B.A. from the

Harvard Business School. Associates in Minnetonka, MN from 1999 until 2006. He was the portfolio manager

for Merced Partners, LP and Tamarack International Limited during that

period. Tom was named a partner of EBF in 1997. He supervised a staff of thirteen people located both in Minnesota and London. This staff was comprised of traders, analysts and support personnel. Tom joined EBF in 1989 as

a Trader. Prior to his employment at EBF, from 1987 to 1989, Tom held

various trading positions in the Financial Markets Department at Cargill, Inc. From 1981 until 1987 Tom was employed in the Domestic Soybean Processing Division at Cargill in both trading and managerial roles. Tom holds a

B.B.A. from the University of Iowa with a major in Finance. based in New York and Beijing from 2002 to 2007, where he was part of a team that

managed approximately $40 billion in mortgage backed securities. From

1999 to 2002, Steve was a Japanese convertible bond trader at Citadel Investment Group in Chicago. Prior to that, he was head of mortgage backed securities trading at Cargill. He has 16 years mortgage-related trading

experience. Steve holds a B.A. in Economics with Honors from Harvard. asset-backed securities. Prior to joining Pine River in 2009, Bill

was Managing Director at Citigroup and its predecessor firm, Salomon Brothers Inc. From 2004 to 2009, Bill managed a proprietary trading book at Citigroup with

particular focus on mortgage and asset-backed securities. From 1994 to 2004, Bill was part of the Salomon/Citi New York Mortgage Sales Department. From 1981

to 1994, Bill was based in Chicago and managed the Chicago Financial

Institutions Sales Group for Salomon. He was awarded the Masters in Business Administration with a concentration in Finance from the University of Chicago Graduate School of Business. Bill holds a B.S. in Finance and

Economics from Miami University. Brian Taylor, Chairman. Brian Taylor founded Pine River in 2002 and is responsible for management of the business and oversight of the funds. Prior Mark D. Ein, Vice-Chairman. Mark Ein has served as CEO of Capitol Acquisition Corp. since its inception in November 2007. Mark is the Founder Thomas Siering, Chief Executive & Director. Prior to joining Pine River in 2006, Tom was head of the Value Investment Group at EBF & Steve Kuhn, Co-Chief Investment Officer. Prior to joining Pine River in 2008, Steve was a Vice President and Portfolio Manager at Goldman Sachs Bill Roth, Co-Chief Investment Officer. Bill has 28 years of experience in the Fixed Income Markets, with specific expertise in mortgage-backed and |

29 Two Harbors Investment Corp. Experienced Team Jeff Stolt, Chief Financial Officer. Prior to co-founding Pine River in 2002, Jeff was the Controller at EBF &

Associates from 1997 to 2002. In this role, Jeff oversaw the preparation

of all fund accounting statements, managed the offshore administrator relationship, managed the audit process and was responsible for tax planning and reporting. Jeff began employment with EBF in 1989.

Prior to that, Jeff was an accountant in Cargill, Inc.’s Financial Markets Department from 1986 until 1989. Jeff holds a B.S. in Accounting and Finance

from the Minnesota State University. Tim O’Brien, General

Counsel. Prior to joining Pine River in 2007, Tim previously served as

Vice President and General Counsel of NRG Energy, Inc. from 2004 until

2006. He served as Deputy General Counsel of NRG Energy from 2000 to 2004 and Assistant General Counsel from 1996 to 2000. Prior to joining NRG, Tim was an associate at Sheppard, Mullin, Richter & Hampton

in Los Angeles and San Diego, California. He holds a B.A. in History from Princeton University and a Juris Doctor degree from the University of Minnesota Law School. Tim attended an eight-week Advanced Management Program at Harvard Business School in the spring of 2007. Andrew Garcia, VP Business Development. Prior to joining in 2008, Andrew was the Event Driven and Business Combination Companies (SPAC) specialist in the Capital Markets division at Maxim Group in New York. Before joining Maxim Group, he was the head trader at Laterman & Company. From 2001 to 2005, he covered institutional event-driven and risk arbitrage

investors as a sales trader, equity sales person, and middle markets sales person at Cathay Financial, Oppenheimer & Co., and CIBC Oppenheimer Corp. Andrew

holds a B.A. from Kenyon College. |

30 Two Harbors Investment Corp. Contact Details Mark Ein Chairman and CEO Capitol Acquisition Corp. 202 654 7001 mark@capitolacquisition.com For further information, please contact: Andrew Garcia VP of Business Development Two Harbors Investment Corp. 612 238 3307 andrew.garcia@twoharborsinvestment.com |