|

·

|

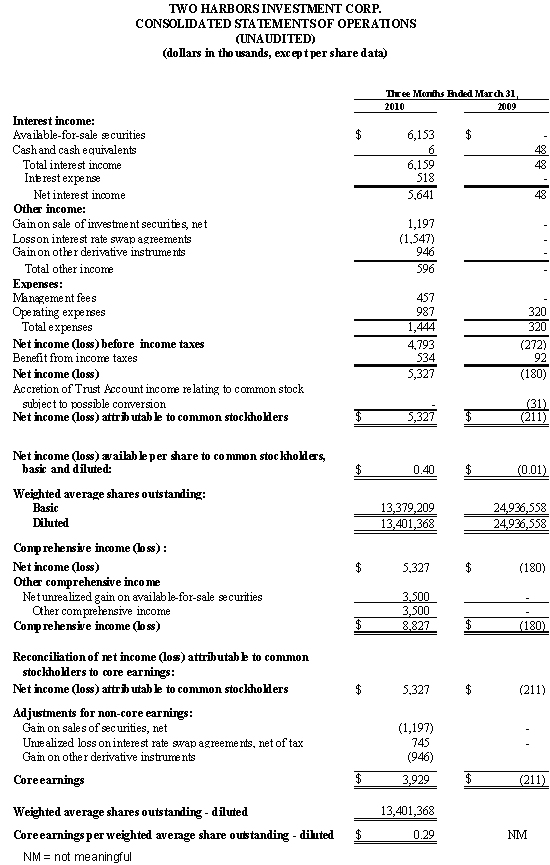

Quarterly

GAAP earnings were $0.40 per diluted common

share

|

|

·

|

Increased

book value per share to $9.38 at March 31, 2010, from $9.08 as of December

31, 2009

|

|

·

|

Achieved

a 17.1% annualized return on average equity on a GAAP

basis

|

|

·

|

Declared

a dividend of $0.36 per common

share

|

|

Two

Harbors Portfolio

|

||||||||

|

(dollars in thousands, except per share

data)

|

||||||||

|

|

||||||||

|

Portfolio Composition

|

As

of March 31, 2010

|

|||||||

|

Agency

Bonds

|

||||||||

|

Fixed

Rate Bonds

|

$ | 122,017 | 23.4 | % | ||||

|

Hybrid

ARMS

|

290,521 | 55.9 | % | |||||

|

Total

Agency

|

412,538 | 79.3 | % | |||||

|

Non-Agency

Bonds

|

||||||||

|

Senior

Bonds

|

88,345 | 17.0 | % | |||||

|

Mezzanine

Bonds

|

19,286 | 3.7 | % | |||||

|

Total Non-Agency

|

107,631 | 20.7 | % | |||||

|

Aggregate

Portfolio

|

$ | 520,169 | ||||||

|

Fixed-rate

investment securities as a percentage of portfolio

|

32.3 | % | ||||||

|

Adjustable-rate

investment securities as a percentage of portfolio

|

67.7 | % | ||||||

|

For

the Quarter Ended

|

||||||||

|

Portfolio Metrics

|

March 31, 2010

|

|||||||

|

Annualized

yield on average available-for-sale securities during the

quarter

|

||||||||

|

Agency

securities

|

3.6 | % | ||||||

|

Non-Agency

securities

|

10.6 | % | ||||||

|

Aggregate

Portfolio

|

4.9 | % | ||||||

|

Annualized

cost of funds on average repurchase balance during the

quarter

|

0.5 | % | ||||||

|

Annualized

interest rate spread during the quarter

|

4.4 | % | ||||||

|

Weighted

average cost basis of principal and interest securities

|

||||||||

|

Agency

|

$ | 105.0 | ||||||

|

Non-Agency

|

$ | 56.8 | ||||||

|

Weighted

average three month CPR for our portfolio

|

||||||||

|

Agency

|

16.2 | % | ||||||

|

Non-Agency

|

11.6 | % | ||||||

|

Debt-to-equity

ratio at period-end

|

3.6

to 1.0

|

|||||||

|

TWO

HARBORS INVESTMENT CORP.

|

|

CONSOLIDATED

BALANCE SHEETS

|

|

(dollars

in thousands, except per share data)

|

|

ASSETS

|

March

31,

|

December

31,

|

||||||

|

2010

|

2009

|

|||||||

|

(unaudited)

|

||||||||

|

Available-for-sale

securities, at fair value

|

$ | 520,169 | $ | 494,465 | ||||

|

Cash

and cash equivalents

|

25,443 | 26,105 | ||||||

|

Total

earning assets

|

545,612 | 520,570 | ||||||

|

Restricted

cash

|

22,593 | 8,913 | ||||||

|

Accrued

interest receivable

|

2,500 | 2,580 | ||||||

|

Due

from counterparties

|

23,340 | 4,877 | ||||||

|

Derivative

assets, at fair value

|

3,469 | 364 | ||||||

|

Prepaid

expenses

|

602 | 572 | ||||||

|

Deferred

tax assets

|

402 | - | ||||||

|

Prepaid

tax assets

|

499 | 490 | ||||||

|

Total

Assets

|

$ | 599,017 | $ | 538,366 | ||||

|

LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Liabilities

|

||||||||

|

Repurchase

agreements

|

$ | 449,961 | $ | 411,893 | ||||

|

Derivative

liabilities, at fair value

|

16,716 | - | ||||||

|

Accrued

interest payable

|

383 | 114 | ||||||

|

Deferred

tax liabilities

|

- | 124 | ||||||

|

Accrued

expenses and other liabilities

|

1,376 | 1,030 | ||||||

|

Dividends

payable

|

4,825 | 3,484 | ||||||

|

Total

liabilities

|

473,261 | 416,645 | ||||||

|

Common

stock, subject to possible conversion

|

- | - | ||||||

|

Stockholders’

Equity

|

||||||||

|

Preferred

stock, par value $0.01 per share; 50,000,000

|

||||||||

|

shares

authorized; no shares issued and

|

||||||||

|

outstanding

|

- | - | ||||||

|

Common

stock, par value $0.01 per share;

|

||||||||

|

450,000,000

shares authorized and 13,379,209

|

||||||||

|

shares

issued and outstanding

|

134 | 134 | ||||||

|

Additional

paid-in capital

|

131,789 | 131,756 | ||||||

|

Accumulated

other comprehensive income (loss)

|

2,550 | (950 | ) | |||||

|

Cumulative

(losses) earnings

|

(408 | ) | (5,735 | ) | ||||

|

Cumulative

distributions to stockholders

|

(8,309 | ) | (3,484 | ) | ||||

|

Total

stockholders’ equity

|

125,756 | 121,721 | ||||||

|

Total

liabilities and stockholders’ equity

|

$ | 599,017 | $ | 538,366 | ||||