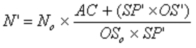

where,

|

N’ =

|

the

adjusted number of shares of Common Stock issuable upon exercise of each

Warrant;

|

|

No =

|

the

current number of shares of Common Stock issuable upon exercise of each

warrant;

|

11

|

AC =

|

the

aggregate value of all cash and any other consideration (as determined by

the board of directors of the Company) paid or payable for shares

purchased in such tender or exchange

offer;

|

|

Oso =

|

the

number of shares of Common Stock outstanding immediately prior to the date

such tender or exchange offer

expires;

|

|

OS’ =

|

the

number of shares of Common Stock outstanding immediately after the date

such tender or exchange offer expires;

and

|

|

SP’

=

|

the

Closing Price of the Common Stock on the trading day next succeeding the

date such tender or exchange offer

expires.

|

The

adjustment shall be made successively and shall become effective immediately

following the date such tender or exchange offer expires.

4.7 Consideration

Received. For purposes of any computation respecting consideration

received pursuant to Sections 4.4, 4.5 and 4.6, the following shall

apply:

(1) in

the case of the issuance of shares of Common Stock for cash, the consideration

shall be the amount of such cash, provided that in no case shall any deduction

be made for any commissions, discounts or other expenses incurred by the Company

for any underwriting or other sale or disposition of the issue or otherwise in

connection therewith;

(2) in

the case of the issuance of shares of Common Stock for a consideration in whole

or in part other than cash, the consideration other than cash shall be deemed to

be the fair market value thereof as reasonably determined by the board of

directors of the Company (irrespective of the accounting treatment thereof) and

described in a board resolution which shall be filed with the Warrant Agent;

and

(3) in

the case of the issuance of securities convertible into or exchangeable for

shares, the aggregate consideration received therefor shall be deemed to be the

consideration received by the Company for the issuance of such securities plus

the additional minimum consideration, if any, to be received by the Company upon

the conversion or exchange thereof for the maximum number of shares used to

calculate the adjustment (the consideration in each case to be

determined in the same manner as provided in clauses (1) and (2) of this Section

4.7).

12

4.8 Defined Terms; When De

Minimis Adjustment May Be Deferred. As used in this Section

4:

(1) The

“Closing Price” of the Common Stock on any date of determination

means;

|

|

(i)

|

the

closing sale price for the regular trading session (without considering

after hours or other trading outside regular trading session hours) of the

Common Stock (regular way) on the American Stock Exchange on that date

(or, if no closing price is reported, the last reported sale price during

that regular trading session),

|

|

|

(ii)

|

if

the Common Stock is not listed for trading on the American Stock Exchange

on that date, as reported in the composite transactions for the principal

United States securities exchange on which the Common Stock is so

listed,

|

|

|

(iii)

|

if

the Common Stock is not so reported, the last quoted bid price for the

Common Stock in the over-the-counter market as reported by the OTC

Bulletin Board, the National Quotation Bureau or similar organization,

or

|

|

|

(iv)

|

if

the Common Stock is not so quoted, the average of the mid-point of the

last bid and ask prices for the Common Stock from at least three

nationally recognized investment banking firms that the Company selects

for this purpose.

|

(2) “ex-dividend

date” means the first date on which the shares of Common Stock trade on the

applicable exchange or in the applicable market, regular way, without the right

to receive the issuance or distribution in question;

(3) “trading

day” means, with respect to the Common Stock or any other security, a day during

which (i) trading in the Common Stock or such other security generally occurs,

(ii) there is no market disruption event (as defined below) and (iii) a Closing

Price for the Common Stock or such other security (other than a Closing Price

referred to in the next to last clause of such definition) is available for such

day; provided that if

the Common Stock or such other security is not admitted for trading or quotation

on or by any exchange, bureau or other organization, “trading day” will mean any

Business Day;

13

(4) “market

disruption event” means, with respect to the Common Stock or any other security,

the occurrence or existence of more than one-half hour period in the aggregate

or any scheduled trading day for the Common Stock or such other security of any

suspension or limitation imposed on trading (by reason of movements in price

exceeding limits permitted by the stock exchange or otherwise) in the Common

Stock or such other security or in any options, contract, or future contracts

relating to the Common Stock or such other security, and such suspension or

limitation occurs or exists at any time before 1:00 p.m. (New York time) on such

day; and

(5) “Business

Day” means, any day on which the American Stock Exchange is open for trading and

which is not a Saturday, a Sunday or any other day on which banks in the City of

New York, New York, are authorized or required by law to close.

No

adjustment in the number of shares of Common Stock issuable upon exercise of

each Warrant need be made unless the adjustment would require an increase or

decrease of at least 1% in such number. Any adjustments that are not

made shall be carried forward and taken into account in any subsequent

adjustment.

All

calculations under this Section 4 shall be made to the nearest cent or to the

nearest 1/100th of a share, as the case may be.

4.9

When No Adjustment

Required. No adjustment need be made for a transaction referred to in

Sections 4.2, 4.3, 4.4, 4.5 or 4.6 if Warrant holders are to participate,

without requiring the Warrants to be exercised, in the transaction on a basis

and with notice that the board of directors of the Company reasonably determines

to be fair and appropriate in light of the basis and notice on which holders of

Common Stock participate in the transaction.

No

adjustment need be made for a change in the par value or no par value of the

Common Stock.

To

the extent the Warrants become convertible into cash, no adjustment need be made

thereafter as to the amount of cash into which such Warrants are

exercisable. Interest will not accrue on the cash.

4.10

Notice of

Adjustment. Whenever the number of shares of Common Stock issuable upon

exercise of each Warrant is adjusted, the Company shall provide the notices

required by Section 4.19 hereof.

14

4.11 Notice of Certain

Transactions. If:

(1) the

Company takes any action that would require an adjustment in the Warrant Price

pursuant to Sections 4.1, 4.2, 4.3, 4.4, 4.5 or 4.6 and if the Company does not

arrange for Warrant holders to participate pursuant to Section 4.9;

(2) the

Company takes any action that would require a supplemental Warrant Agreement

pursuant to Section 4.12; or

(3) there

is a liquidation or dissolution of the Company,

the

Company shall mail to Warrant holders a notice stating the proposed record date

for a dividend or distribution or the proposed effective date of a subdivision,

combination, reclassification, consolidation, merger, transfer, lease,

liquidation or dissolution. The Company shall mail the notice at

least 15 days before such date. Failure to mail the notice or any

defect in it shall not affect the validity of the transaction.

4.12 Reorganization of

Company. If the Company consolidates or merges with or into, or transfers

or leases all or substantially all its assets to, any person, upon consummation

of such transaction the Warrants shall automatically become exercisable for the

kind and amount of securities, cash or other assets which the holder of a

Warrant would have owned immediately after the consolidation, merger, transfer

or lease if such holder had exercised the Warrant immediately before the

effective date of the transaction; provided that (i) if the

holders of Common Stock were entitled to exercise a right of election as to the

kind or amount of securities, cash or other assets receivable upon such

consolidation or merger, then the kind and amount of securities, cash or other

assets for which each Warrant shall become exercisable shall be deemed to be the

weighted average of the kind and amount received per share by the holders of

Common Stock in such consolidation or merger that affirmatively make such

election or (ii) if a tender or exchange offer shall have been made to and

accepted by the holders of Common Stock under circumstances in which, upon

completion of such tender or exchange offer, the maker thereof, together with

members of any group (within the meaning of Rule 13d-5(b)(1) under the Exchange

Act) of which such maker is a part, and together with any affiliate or associate

of such maker (within the meaning of Rule 12b-2 under the Exchange Act) and any

members of any such group of which any such affiliate or associate is a part,

own beneficially (within the meaning of Rule 13d-3 under the Exchange Act) more

than 50% of the outstanding shares of Common Stock, the holder of a Warrant

shall be entitled to receive the highest amount of cash, securities or other

property to which such holder would actually have been entitled as a shareholder

if such Warrant holder had exercised the Warrant prior to the expiration of such

tender or exchange offer, accepted such offer and all of the Common Stock held

by such holder had been purchased pursuant to such tender or exchange offer,

subject to adjustments (from and after the consummation of such tender or

exchange offer) as nearly equivalent as possible to the adjustments provided for

in this Section 4. Concurrently with the consummation of any such

transaction, the corporation or other entity formed by or surviving any such

consolidation or merger if other than the Company, or the person to which such

sale or conveyance shall have been made, shall enter into a supplemental Warrant

Agreement so providing and further providing for adjustments which shall be as

nearly equivalent as may be practical to the adjustments provided for in this

Section 4. The successor Company shall mail to Warrant holders a

notice describing the supplemental Warrant Agreement.

15

If the

issuer of securities deliverable upon exercise of Warrants under the

supplemental Warrant Agreement is an affiliate of the formed, surviving,

transferee or lessee corporation, that issuer shall join in the supplemental

Warrant Agreement.

If this

Section 4.12 applies, Sections 4.1, 4.2, 4.3, 4.4, 4.5 and 4.6 do not

apply.

4.13 Warrant Agent’s

Disclaimer. The Warrant Agent has no duty to determine when an adjustment

under this Section 4 should be made, how it should be made or what it should

be. The Warrant Agent has no duty to determine whether any provisions

of a supplemental Warrant Agreement under Section 4.12 are

correct. The Warrant Agent makes no representation as to the validity

or value of any securities or assets issued upon exercise of

Warrants. The Warrant Agent shall not be responsible for the

Company’s failure to comply with this Section 4.

4.14 When Issuance or Payment May

Be Deferred. In any case in which this Section 4 shall require that an

adjustment in the number of shares of Common Stock issuable upon exercise of

each Warrant be made effective as of a record date for a specified event, the

Company may elect to defer until the occurrence of such event (i) issuing to the

holder of any Warrant exercised after such record date the Warrant Shares and

other capital stock of the Company, if any, issuable upon such exercise over and

above the Warrant Shares and other capital stock of the Company, if any,

issuable upon such exercise on the basis of the number of shares of Common Stock

issuable upon exercise of each Warrant and (ii) paying to such holder any amount

in cash in lieu of a fractional share pursuant to Section 4.18 hereof; provided, however, that the Company

shall deliver to such holder a due bill or other appropriate instrument

evidencing such holder’s right to receive such additional Warrant Shares, other

capital stock and cash upon the occurrence of the event requiring such

adjustment.

16

4.15 Adjustment in Warrant

Price. Upon each event that provides for an adjustment of the number of

shares of Common Stock issuable upon exercise of each Warrant pursuant to this

Section 4, each Warrant outstanding prior to the making of the adjustment shall

thereafter have an adjusted Warrant Price (calculated to the nearest ten

millionth) obtained from the following formula:

where:

|

E’=

|

the

adjusted Warrant Price.

|

|

E

=

|

the

Warrant Price prior to adjustment.

|

|

|

N’

=

|

the

adjusted number of Warrant Shares issuable upon exercise of a Warrant by

payment of the adjusted Warrant

Price.

|

|

|

N =

|

the

number of Warrant Shares previously issuable upon exercise of a Warrant by

payment of the Warrant Price prior to

adjustment.

|

Following

any adjustment to the Warrant Price pursuant to this Section 4, the amount

payable, when adjusted and together with any consideration allocated to the

issuance of the Warrants, shall never be less than the par value per Warrant

Share at the time of such adjustment. Such adjustment shall be made

successively whenever any event listed above shall occur.

4.16 Form of Warrants.

Irrespective of any adjustments in the number or kind of shares issuable upon

the exercise of the Warrants or the Warrant Price, Warrants theretofore or

thereafter issued may continue to express the same number and kind of shares and

Warrant Price as are stated in the Warrants initially issuable pursuant to this

Agreement.

4.17 Other Dilutive

Events. In case any event shall occur affecting the Company, as to which

the provisions of this Section 4 are not strictly applicable, but would impact

the holders of Warrants adversely as compared to holders of Common Stock, and

the failure to make any adjustment would not fairly protect the purchase rights

represented by the Warrants in accordance with the essential intent and

principles of this Section then, in each such case, the Company shall appoint a

firm of independent public accountants, investment banking or other appraisal

firm of recognized national standing which shall give their opinion upon the

adjustment, if any, on a basis consistent with the essential intent and

principles established in this Section 4, necessary to preserve, without

dilution, the purchase rights represented by the Warrants.

17

4.18 Fractional Interests.

The Company shall not be required to issue fractional shares of Common Stock on

the exercise of Warrants. If more than one Warrant shall be presented

for exercise in full at the same time by the same holder, the number of full

shares of Common Stock which shall be issuable upon the exercise thereof shall

be computed on the basis of the aggregate number of shares of Common Stock

purchasable on exercise of the Warrants so presented. If any fraction

of a shares of Common Stock would, except for the provisions of this Section

4.18, be issuable on the exercise of any Warrants (or specified portion

thereof), the Company shall pay an amount in cash equal to the fair market value

on the day immediately preceding the date the Warrant is presented for exercise,

multiplied by such fraction.

4.19 Notices to Warrant

Holders. Upon any adjustment of the Warrant Price pursuant to

Section 4, the Company shall promptly thereafter, and in any event within five

days, (i) cause to be filed with the Warrant Agent a certificate executed

by the Chief Financial Officer of the Company setting forth the number of shares

of Common Stock issuable upon exercise of each Warrant after such adjustment and

setting forth in reasonable detail the method of calculation and the facts upon

which such calculations are based, and (ii) cause to be given to each of

the registered holders of the Warrant Certificates at his address appearing on

the Warrant register written notice of such adjustments by first-class mail,

postage prepaid. Where appropriate, such notice may be given in

advance and included as a part of the notice required to be mailed under the

other provisions of this Section 4.19. The Warrant Agent shall be

fully protected in relying on any such certificate and on any adjustment therein

contained and shall not be deemed to have knowledge of such adjustment unless

and until it shall have received such certificate.

In

case:

(a) the

Company shall authorize the issuance to all holders of shares of Common Stock of

rights, options or warrants to subscribe for or purchase shares of Common Stock

or of any other subscription rights or warrants; or

(b) the

Company shall authorize the distribution to all holders of shares of Common

Stock of evidences of its indebtedness or assets (other than regular cash

dividends or dividends payable in shares of Common Stock or distributions

referred to in Section 4.2 hereof); or

18

(c) of

any consolidation or merger to which the Company is a party and for which

approval of any shareholders of the Company is required, or of the conveyance or

transfer of the properties and assets of the Company substantially as an

entirety, or of any reclassification or change of Common Stock issuable upon

exercise of the Warrants (other than a change in par value, or from par value to

no par value, or from no par value to par value, or as a result of a subdivision

or combination), or a tender offer or exchange offer for shares of Common Stock;

or

(d) of

the voluntary or involuntary dissolution, liquidation or winding up of the

Company; or

(e) the

Company proposes to take any action not specified above which would require an

adjustment of the Warrant Price pursuant to Section 4 hereof;

then the

Company shall cause to be filed with the Warrant Agent and shall cause to be

given to each of the registered holders of the Warrant Certificates at his

address appearing on the Warrant register, at least 10 calendar days prior to

the applicable record date hereinafter specified, or as promptly as practicable

under the circumstances in the case of events for which there is no record date,

by first-class mail, postage prepaid, a written notice stating (i) the date

as of which the holders of record of shares of Common Stock to be entitled to

receive any such rights, options, warrants or distribution are to be determined,

or (ii) the initial expiration date set forth in any tender offer or

exchange offer for shares of Common Stock, or (iii) the date on which any

such consolidation, merger, conveyance, transfer, dissolution, liquidation or

winding up is expected to become effective or consummated, and the date as of

which it is expected that holders of record of shares of Common Stock shall be

entitled to exchange such shares for securities or other property, if any,

deliverable upon such reclassification, consolidation, merger, conveyance,

transfer, dissolution, liquidation or winding up. The failure to give

the notice required by this Section 4.19 or any defect therein shall not affect

the legality or validity of any distribution, right, option, warrant,

consolidation, merger, conveyance, transfer, dissolution, liquidation or winding

up, or the vote upon any action.

Nothing

contained in this Agreement or in any of the Warrant Certificates shall be

construed as conferring upon the holders thereof the right to vote or to consent

or to receive notice as shareholders in respect of the meetings of shareholders

or the election of directors of the Company or any other matter, or any rights

whatsoever as shareholders of the Company.

19

4. Transfer and Exchange of

Warrants.

4.1. Registration of

Transfer. The Warrant Agent shall register the transfer, from

time to time, of any outstanding Warrant upon the Warrant Register, upon

surrender of such Warrant for transfer, properly endorsed with signatures

properly guaranteed and accompanied by appropriate instructions for

transfer. Upon any such transfer, a new Warrant representing an equal

aggregate number of Warrants shall be issued and the old Warrant shall be

cancelled by the Warrant Agent. The Warrants so cancelled shall be

delivered by the Warrant Agent to the Company from time to time upon

request.

4.2. Procedure for Surrender of

Warrants. Warrants may be surrendered to the Warrant Agent,

together with a written request for exchange or transfer, and thereupon the

Warrant Agent shall issue in exchange therefor one or more new Warrants as

requested by the registered holder of the Warrants so surrendered, representing

an equal aggregate number of Warrants; provided, however, that in the event that

a Warrant surrendered for transfer bears a restrictive legend, the Warrant Agent

shall not cancel such Warrant and issue new Warrants in exchange therefor until

the Warrant Agent has received an opinion of counsel for the Company stating

that such transfer may be made and indicating whether the new Warrants must also

bear a restrictive legend.

4.3. Fractional

Warrants. The Warrant Agent shall not be required to effect

any registration of transfer or exchange which will result in the issuance of a

warrant certificate for a fraction of a warrant.

4.4. Service

Charges. No service charge shall be made for any exchange or

registration of transfer of Warrants.

4.5. Warrant Execution and

Countersignature. The Warrant Agent is hereby authorized to

countersign and to deliver, in accordance with the terms of this Agreement, the

Warrants required to be issued pursuant to the provisions of this Section 5, and

the Company, whenever required by the Warrant Agent, will supply the Warrant

Agent with Warrants duly executed on behalf of the Company for such

purpose.

20

5. Redemption.

5.1. Redemption. Subject

to Section 6.4 hereof, not less than all of the outstanding Warrants may be

redeemed, at the option of the Company, at any time while they are exercisable

and so long as an effective registration statement covering the shares of common

stock issuable upon exercise of the Warrants is current and available throughout

the “30-day redemption period” (defined below) and prior to their expiration, at

the office of the Warrant Agent, upon the notice referred to in Section 6.2, at

the price of $.01 per Warrant (“Redemption Price”), provided that the last sales

price of the Common Stock has been at least $14.25 per share (subject to

adjustment in accordance with Section 4 hereof), on each of twenty (20) trading

days within any thirty (30) trading day period ending on the third business day

prior to the date on which notice of redemption is given.

5.2. Date Fixed for, and Notice

of, Redemption. In the event the Company shall elect to redeem

all of the Warrants, the Company shall fix a date for the redemption. Notice of

redemption shall be mailed by first class mail, postage prepaid, by the Company

not less than 30 days prior to the date fixed for redemption (the “30-day

redemption period”) to the registered holders of the Warrants to be redeemed at

their last addresses as they shall appear on the registration books. Any notice

mailed in the manner herein provided shall be conclusively presumed to have been

duly given whether or not the registered holder received such

notice.

5.3. Exercise After Notice of

Redemption. The Warrants may be exercised for cash (or on a

“cashless basis” in accordance with Section 3.3.1 of this Agreement) at any time

after notice of redemption shall have been given by the Company pursuant to

Section 6.2 hereof and prior to the time and date fixed for redemption. On and

after the redemption date, the record holder of the Warrants shall have no

further rights except to receive, upon surrender of the Warrants, the Redemption

Price.

6.4

Exclusion of Certain

Warrants. Any of the Sponsors’ Warrants shall not be redeemable by the

Company as long as such Sponsors’ Warrants continue to be held by the Sponsors

or their permitted transferees (as described in the Subscription Agreements).

However, once the Sponsors or their permitted transferees transfer such

Sponsors’ Warrants, such Sponsors’ Warrants shall then be redeemable by the

Company pursuant to Section 6 hereof.

21

6. Other Provisions Relating to

Rights of Holders of Warrants.

6.1. No Rights as

Stockholder. A Warrant does not entitle the registered holder

thereof to any of the rights of a stockholder of the Company, including, without

limitation, the right to receive dividends, or other distributions, including

the right to participate in any liquidation of the trust account (as described

in the Registration Statement), exercise any preemptive rights to vote or to

consent or to receive notice as stockholders in respect of the meetings of

stockholders or the election of directors of the Company or any other

matter.

6.2. Lost, Stolen, Mutilated, or

Destroyed Warrants. If any Warrant is lost, stolen, mutilated,

or destroyed, the Company and the Warrant Agent may on such terms as to

indemnity or otherwise as they may in their discretion impose (which shall, in

the case of a mutilated Warrant, include the surrender thereof), issue a new

Warrant of like denomination, tenor, and date as the Warrant so lost, stolen,

mutilated, or destroyed. Any such new Warrant shall constitute a

substitute contractual obligation of the Company, whether or not the allegedly

lost, stolen, mutilated, or destroyed Warrant shall be at any time enforceable

by anyone.

6.3. Reservation of Common

Stock. The Company shall at all times reserve and keep

available a number of its authorized but unissued shares of Common Stock that

will be sufficient to permit the exercise in full of all outstanding Warrants

issued pursuant to this Agreement.

6.4. Registration of Common

Stock. The Company agrees that prior to the commencement of

the Exercise Period, it shall use its best efforts to file with the Securities

and Exchange Commission a post-effective amendment to the Registration

Statement, or a new registration statement, for the registration, under the Act,

of, and it shall use its best efforts to take such action as is necessary to

qualify for sale, in those states in which the Warrants were initially offered

by the Company, the Common Stock issuable upon exercise of the

Warrants. In either case, the Company will use its best efforts to

cause the same to become effective and to maintain the effectiveness of such

registration statement until the expiration of the Warrants in accordance with

the provisions of this Agreement. The Warrants shall not be

exercisable and the Company shall not be obligated to issue Common Stock unless,

at the time a holder seeks to exercise the Warrants, a prospectus relating to

Common Stock issuable upon exercise of the Warrants is current and the Common

Stock has been registered or qualified or deemed to be exempt under the

securities laws of the state of residence of the holder of the

Warrants. The provisions of this Section 7.4 may not be

modified, amended or deleted without the prior written consent of

Citigroup.

22

7. Concerning the Warrant Agent

and Other Matters.

7.1. Payment of

Taxes. The Company will from time to time promptly pay all

taxes and charges that may be imposed upon the Company or the Warrant Agent in

respect of the issuance or delivery of shares of Common Stock upon the exercise

of Warrants, but the Company shall not be obligated to pay any transfer taxes in

respect of the Warrants or such shares.

7.2. Resignation, Consolidation,

or Merger of Warrant Agent.

7.2.6. Appointment of Successor

Warrant Agent. The Warrant Agent, or any successor to it

hereafter appointed, may resign its duties and be discharged from all further

duties and liabilities hereunder after giving sixty (60) days’ notice in writing

to the Company. If the office of the Warrant Agent becomes vacant by

resignation or incapacity to act or otherwise, the Company shall appoint in

writing a successor Warrant Agent in place of the Warrant Agent. If

the Company shall fail to make such appointment within a period of 30 days after

it has been notified in writing of such resignation or incapacity by the Warrant

Agent or by the holder of the Warrant (who shall, with such notice, submit his

Warrant for inspection by the Company), then the holder of any Warrant may apply

to the Supreme Court of the State of New York for the County of New York for the

appointment of a successor Warrant Agent at the Company’s cost. Any

successor Warrant Agent, whether appointed by the Company or by such court,

shall be a corporation organized and existing under the laws of the State of New

York, in good standing and having its principal office in the Borough of

Manhattan, City and State of New York, and authorized under such laws to

exercise corporate trust powers and subject to supervision or examination by

federal or state authority. After appointment, any successor Warrant

Agent shall be vested with all the authority, powers, rights, immunities,

duties, and obligations of its predecessor Warrant Agent with like effect as if

originally named as Warrant Agent hereunder, without any further act or deed;

but if for any reason it becomes necessary or appropriate, the predecessor

Warrant Agent shall execute and deliver, at the expense of the Company, an

instrument transferring to such successor Warrant Agent all the authority,

powers, and rights of such predecessor Warrant Agent hereunder; and upon request

of any successor Warrant Agent the Company shall make, execute, acknowledge, and

deliver any and all instruments in writing for more fully and effectually

vesting in and confirming to such successor Warrant Agent all such authority,

powers, rights, immunities, duties, and obligations.

7.2.7. Notice of Successor Warrant

Agent. In the event a successor Warrant Agent shall be

appointed, the Company shall give notice thereof to the predecessor Warrant

Agent and the transfer agent for the Common Stock not later than the effective

date of any such appointment.

23